.

HIGHLY SUBSIDIZED OFFSHORE WIND A DISASTER

https://www.windtaskforce.org/profiles/blogs/highly-subsidized-offs...

By Robert Bryce

The disintegration of the turbine blade and resultant pollution that forced the closure of Nantucket’s beaches should scuttle the offshore wind scam. But it’s only the tip of Big Wind’s problems.

.

The broken GE Halide-X wind turbine at Vineyard Wind, the offshore project owned by Spanish corporation Avangrid and Denmark’s Copenhagen Infrastructure Partners. The 250-ft piece dangling on the mast has since broken off. Photo credit: Nantucket Current, Zac Von Kampen

.

On Saturday, the Nantucket Select Board announced it was considering legal action against Avangrid and Copenhagen Infrastructure Partners, the EUROPEAN corporations that own the $4 billion Vineyard Wind project now under construction in Massachusetts waters. The Select Board will meet today, Monday, in executive session to discuss the litigation.

The news of the possible litigation, which the Nantucket Current published on Saturday, comes less than a week after tons of debris from the broken wind turbine blade that was part of the massive offshore project began washing ashore on the island. The pollution forced the town to temporarily close many of its beaches during the peak summer tourist season while the debris was removed. The beaches have since reopened.

.

Aerial view of debris from the wind turbine being removed from Nantucket’s beaches. Credit: WBZ Boston.

.

As I noted here a week ago, the development of offshore wind energy on the Eastern Seaboard has been promoted by some of America’s biggest climate NGOs, including the Sierra Club, Natural Resources Defense Council, National Wildlife Federation, and Conservation Law Foundation, as well as numerous Democratic politicians at state and federal levels.

But the disaster at Vineyard Wind — and it is a monumental disaster for the offshore wind industry — is spotlighting the environmental risks posed by installing dozens or even hundreds of massive wind turbines and offshore platforms in our oceans.

This disaster happened in calm weather. It doesn’t take much effort to imagine what will happen when a hurricane hits the East Coast.

.

The NGOs have been shameless in their collusion with EUROPEAN corporations, including oil companies like Equinor and Total, that are eagerly queueing up to collect billions of Biden/Harris federal tax credits.

But the turbine blade failure at Vineyard Wind is only part of a broader crisis facing Big Wind, both onshore and offshore. Before I talk about that crisis, and hurricanes, a bit of background is needed.

.

The Vineyard Wind project aims to have 800 megawatts of capacity.

It will require installing 62 offshore platforms on the Eastern Seaboard in the midst of known North Atlantic Right Whale Habitat.

Each turbine will have a capacity of about 13 megawatts. A handful of turbines have been installed and the project began producing power in January.

.

.

Public sentiment about “clean” energy on display in Nantucket. The Nantucket Current posted this photo on Twitter on Friday.

.

On Saturday, I talked to Amy DiSibio, a board member of ACK 4 Whales, the Nantucket group fighting offshore wind.

“People are pissed,” she said. “They are really upset for a lot of reasons.” (ACK 4 Whales has sued to stop the project, arguing that the federal government ignored the Endangered Species Act when it issued the permit.

A federal judge rejected their case in April, but the group is appealing their case to the U.S. Supreme Court.)

.

One of the reasons for the anger is obvious: the turbine blade began disintegrating on Saturday evening and sent some 17 cubic yards of debris into the ocean.

But the owners of Vineyard Wind didn’t notify officials in Nantucket until Monday at about 5 pm.

On Tuesday, the Bureau of Safety and Environmental Enforcement, which is part of the Interior Department, issued a stop work order at Vineyard Wind, “until further notice.”

On Thursday, as the beach cleanup was ongoing, the remaining portion of the massive turbine blade, a chunk about 300 feet long, fell into the Atlantic Ocean.

The Coast Guard warned mariners in the area of the wind project, which is located 15 miles south of Nantucket and Martha's Vineyard, to “use extreme caution” when passing through the region.

.

.

On Sunday afternoon, Nantucket fisherman and former Select Board member Bob DeCosta sent me this selfie from his boat, The Albacore. “Big Wind is not green. The only thing green about it is the money going to the European offshore wind companies.”

.

On Sunday afternoon, I talked to Bob DeCosta, a fisherman on Nantucket who started fishing with his father when he was nine.

“I’ve been on the water for 56 years,” he told me from his boat. “I don’t have a Ph.D. But like the other fishermen here, I know the tides, and the waters better than anybody.

They never talked to us.

These wind turbines are getting steamrolled over us.

Big Wind is not green. The only thing green about it is the money going to the offshore wind companies.”

.

DeCosta, who served on the Nantucket Select Board for six years, operates a 35-foot charter boat, The Albacore, with his son, Ray.

DeCosta said he steered his vessel through the area near Vineyard Wind early last Sunday morning through thick fog but didn’t know that debris from the shattered turbine blade was in the water.

DeCosta said he could have unwittingly hit the debris which would have done significant damage to his boat. “For 48 hours, that stuff was floating around, and we knew nothing about it. It’s unacceptable.”

.

In addition to the public relations disaster at Vineyard Wind, Big Wind is facing a crisis caused by simple physics.

The turbines now being deployed onshore and offshore are failing far sooner than expected. Why? They have gotten too big. Yes, bigger wind turbines are more efficient than their smaller cousins. But the larger the turbine, the more its components get hit by the stresses that come with their size and weight.

The GE Vernova Haliade-X wind turbine used at Vineyard Wind stands 260 meters high and sweeps an area of 38,000 square meters. That means the turbine captures wind energy over an area five times larger than a soccer pitch.

.

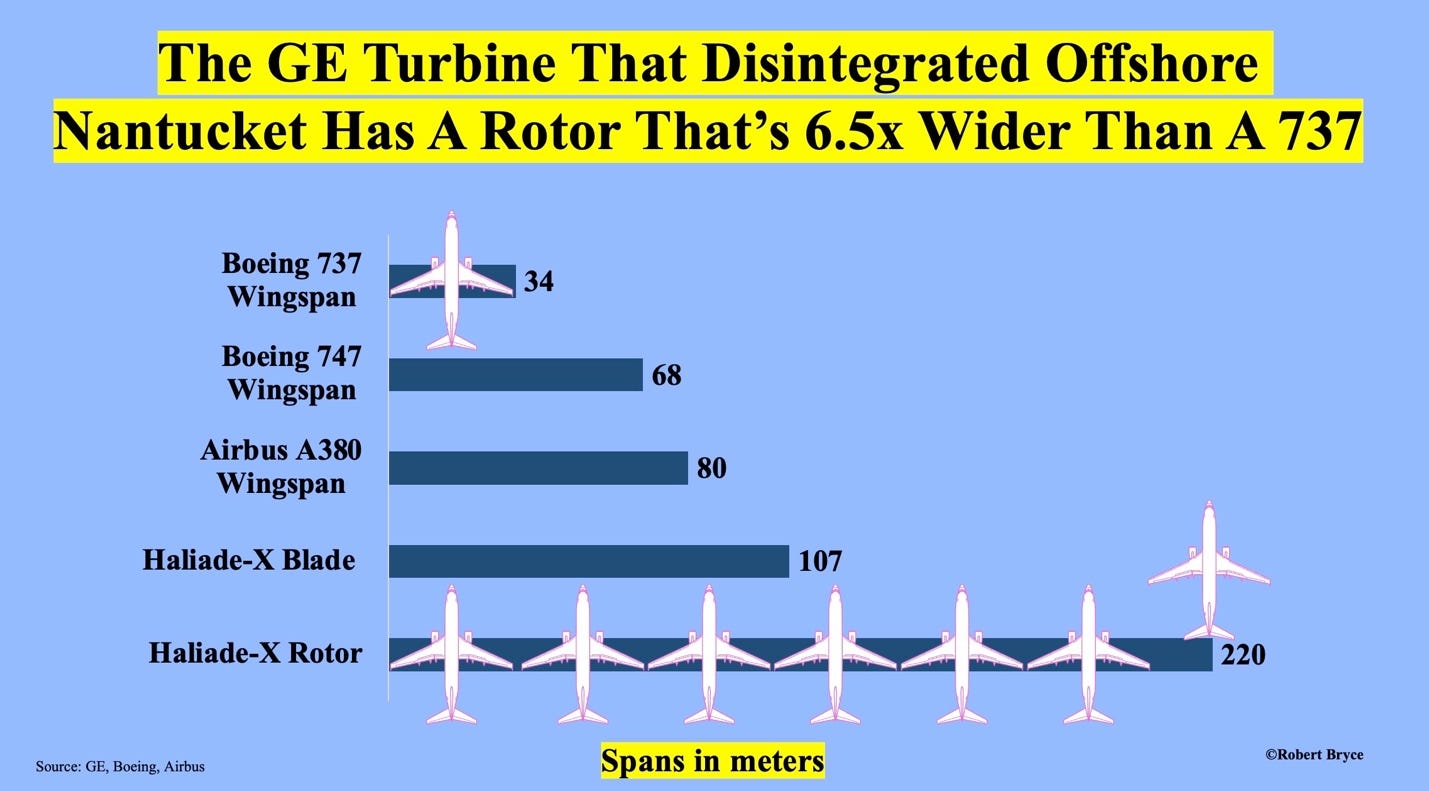

But here’s the critical part: its blades are 107 meters (351 feet) long and weigh 70 tons. In addition, the rotor of the massive machine spans 220 meters.

For comparison, the wingspan of a Boeing 737 is 34 meters.

In other words, the turbines at Vineyard Wind are nearly as tall as the Eiffel Tower and each of their blades weighs more than a fully loaded 737.

.

.

As shown in the graphic above, the Haliade-X rotor is six and a half times wider than the wingspan of a 737. Given the enormity of the machines, it’s no wonder they are failing.

How bad is the problem?

On June 28, Ohio-based American Electric Power sued GE Vernova in New York court, claiming widespread issues with the turbines it has deployed at three wind projects in Oklahoma.

The complaint says:

Within only two to three years of commercial operation, the GE wind turbine generators have exhibited numerous material defects on major components and experienced several complete failures, at least one turbine blade liberation event, and other deficiencies...[a]significant portion of the wind turbine generators have completely failed or have otherwise been rendered inoperable, requiring immediate repair

.

According to a July 2 article in Renews.Biz, AEP, a publicly traded utility with 5.6 million customers, says that it has already incurred:

“millions of dollars in costs and damages in the future” because it will “inevitably need to repair and/or replace” additional wind turbine generators in order to meet the energy production requirements of its customers.

It went on to allege that GE Vernova has refused to acknowledge responsibility to repair and/or replace all defective wind turbine generators.

AEP said that in addition to its claim for cash damages, it is seeking a declaratory judgment that GE Vernova is liable for expected future failures of its wind turbine generators.

.

Adding intrigue to the AEP lawsuit and the failure of the turbine blade at Vineyard Wind is that GE Vernova has not issued any press releases or filed any documents with the SEC to acknowledge its potential liabilities.

The company will hold its second-quarter earnings call on Wednesday and it may disclose more dismal results from its wind business.

In the first quarter, it reported a 40% decline in new wind turbine orders from a year ago.

It also saw a 6% decline in revenue.

.

How much is at stake in the AEP vs. GE Vernova litigation? According to one report, the turbines with failures have a capacity of 1.5 gigawatts and cost $6.4 billion.

Thus, it’s easy to imagine that GE Vernova could be on the hook for hundreds of millions of dollars in losses. Furthermore, those losses may be only part of the company’s long-term liabilities.

.

GE Vernova isn’t the only wind turbine maker being mauled by physics.

Last year, Germany’s Siemens Energy, announced it would take a $2.4 billion loss on its wind business due to quality proble....

And remember, these failures and losses are happening with onshore wind turbines.

The looming operation and maintenance costs for offshore wind will be astronomical.

.

Among the most disgusting aspects of the offshore wind scam — including the fact, EUROPEAN companies are collecting billions of dollars of Biden/Harris tax credits so they can industrialize our oceans and do harm to our fisheries, and the critically endangered North Atlantic Right Whale — is that the current disaster was easily foreseen.

Just 16 months ago, during the CERAWeek energy conference in Houston, the CEO of NextEra Energy, John Ketchum, called offshore wind “a bad bet.”

.

NextEra has been hyper-aggressive in its pursuit of subsidies by building numerous solar and wind projects in rural communities across the country and Canada.

And while its business tactics are often odious, NextEra is the world’s largest producer of unreliable, highly subsidized wind and solar electricity, which means Ketchum knows the industry.

Ketchum said of offshore wind, “We find it hard enough just to take care of a fleet onshore with some of the issues that we deal with as a company, and we're best in class.”

Reuters went on to quote him thusly:

Ketchum said some of the industry's complications included saltwater corrosion, the threat of hurricanes, the availability of ships, and the installation of subsea transmission cables, and added that supply chain issues have driven up the costs.

.

The crucial part of Ketchum’s statement, is, of course, “the threat of hurricanes.” If GE’s wind turbine blades are coming apart now, during a calm summer day, imagine the calamity when a moderate or large hurricane slams the Eastern Seaboard.

The damage to turbines at Vineyard Wind and other offshore projects will be massive and the damage to beaches and fisheries will be enormous. We are soooo being screwed!

DeCosta is staggered by the size of the wind turbines and furious at how Nantucket’s residents and fishermen have been ignored.

“There are other ways to produce energy without doing this to our oceans,” he said. “I know a thing or two about the saltwater environment.

I can’t imagine what it will take to keep these things running in salt water.”

When asked about the damage a hurricane would do to the turbines, he said, “We will be picking up the pieces from this on the beaches at Nantucket for the next 20 years.”

He then asked a critical question that remains unanswered: “When this stuff is obsolete, who’s going to pay to remove it? They are talking about a total of 1,400 of these things.”

.

DeCosta told me the turbine blade failure at Vineyard Wind is, in a way, good for opponents like him.

“My hope is that we make enough of a stink that they don’t put up any more of these things. We aren’t giving up.”

World Offshore Wind Capacity Placed on Operation in 2021

During 2021, worldwide offshore wind capacity placed in operation was 17,398 MW, of which China 13,790 MW, and the rest of the world 3,608 MW, of which UK 1,855 MW; Vietnam 643 MW; Denmark 604 MW; Netherlands 402 MW; Taiwan 109 MW

Of the 17,398 MW, just 57.1 MW was floating, about 1/3%

At end of 2021, 50,623 MW was in operation, of which just 123.4 MW was floating, about 1/4%

https://www.energy.gov/eere/wind/articles/offshore-wind-market-repo...

Floating Offshore Wind Systems in the Impoverished State of Maine

https://www.windtaskforce.org/profiles/blogs/floating-offshore-wind...

Despite the meager floating offshore MW in the world, pro-wind politicians, bureaucrats, etc., aided and abetted by the lapdog Main Media and "academia/think tanks", in the impoverished State of Maine, continue to fantasize about building 3,000 MW of 850-ft-tall floating offshore wind turbines by 2040!!

Maine government bureaucrats, etc., in a world of their own climate-fighting fantasies, want to have about 3,000 MW of floating wind turbines by 2040; a most expensive, totally unrealistic goal, that would further impoverish the already-poor State of Maine for many decades.

Those bureaucrats, etc., would help fatten the lucrative, 20-y, tax-shelters of mostly out-of-state, multi-millionaire, wind-subsidy chasers, who likely have minimal regard for: 1) Impacts on the environment and the fishing and tourist industries of Maine, and 2) Already-overstressed, over-taxed, over-regulated Maine ratepayers and taxpayers, who are trying to make ends meet in a near-zero, real-growth economy.

Those fishery-destroying, 850-ft-tall floaters, with 24/7/365 strobe lights, visible 30 miles from any shore, would cost at least $7,500/ installed kW, or at least $22.5 billion, if built in 2023 (more after 2023)

Almost the entire supply of the Maine projects would be designed and made in Europe, then transported across the Atlantic Ocean, in European specialized ships, then unloaded at a new, $500-million Maine storage/pre-assembly/staging/barge-loading area, then barged to European specialized erection ships for erection of the floating turbines. The financing will be mostly by European pension funds.

About 500 Maine people would have jobs during the erection phase

The other erection jobs would be by specialized European people, mostly on cranes and ships

About 200 Maine people would have long-term O&M jobs, using European spare parts, during the 20-y electricity production phase.

https://www.maine.gov/governor/mills/news/governor-mills-signs-bill...

The Maine people have much greater burdens to look forward to for the next 20 years, courtesy of the Governor Mills incompetent, woke bureaucracy that has infested the state government

The Maine people need to finally wake up, and put an end to the climate scare-mongering, which aims to subjugate and further impoverish them, by voting the entire Democrat woke cabal out and replace it with rational Republicans in 2024

The present course leads to financial disaster for the impoverished State of Maine and its people.

The purposely-kept-ignorant Maine people do not deserve such maltreatment

Electricity Cost: Assume a $750 million, 100 MW project consists of foundations, wind turbines, cabling to shore, and installation at $7,500/kW.

Production 100 MW x 8766 h/y x 0.40, CF = 350,640,000 kWh/y

Amortize bank loan for $525 million, 70% of project, at 6.5%/y for 20 years, 13.396 c/kWh.

Owner return on $225 million, 30% of project, at 10%/y for 20 years, 7.431 c/kWh

Offshore O&M, about 30 miles out to sea, 8 c/kWh.

Supply chain, special ships, and ocean transport, 3 c/kWh

All other items, 4 c/kWh

Total cost 13.396 + 7.431 + 8 + 3 + 4 = 35.827 c/kWh

Less 50% subsidies (ITC, 5-y depreciation, interest deduction on borrowed funds) 17.913 c/kWh

Owner sells to utility at 17.913 c/kWh

NOTE: The above prices compare with the average New England wholesale price of about 5 c/kWh, during the 2009 - 2022 period, 13 years, courtesy of:

Gas-fueled CCGT plants, with low-cost, low-CO2, very-low particulate/kWh

Nuclear plants, with low-cost, near-zero CO2, zero particulate/kWh

Hydro plants, with low-cost, near-zero-CO2, zero particulate/kWh

Cabling to Shore Plus $Billions for Grid Expansion on Shore: A high voltage cable would be hanging from each unit, until it reaches bottom, say about 200 to 500 feet.

The cables would need some type of flexible support system

There would be about 5 cables, each connected to sixty, 10 MW wind turbines, making landfall on the Maine shore, for connection to 5 substations (each having a 600 MW capacity, requiring several acres of equipment), then to connect to the New England HV grid, which will need $billions for expansion/reinforcement to transmit electricity to load centers, mostly in southern New England.

Floating Offshore a Major Burden on Maine People: Over-taxed, over-regulated, impoverished Maine people would buckle under such a heavy burden, while trying to make ends meet in the near-zero, real-growth Maine economy. Maine folks need lower energy bills, not higher energy bills.

APPENDIX 2

Floating Offshore Wind in Norway

Equinor, a Norwegian company, put in operation, 11 Hywind, floating offshore wind turbines, each 8 MW, for a total of 88 MW, in the North Sea. The wind turbines are supplied by Siemens, a German company

Production will be about 88 x 8766 x 0.5, claimed lifetime capacity factor = 385,704 MWh/y, which is about 35% of the electricity used by 2 nearby Norwegian oil rigs, which cost at least $1.0 billion each.

On an annual basis, the existing diesel and gas-turbine generators on the rigs, designed to provide 100% of the rigs electricity requirements, 24/7/365, will provide only 65%, i.e., the wind turbines have 100% back up.

The generators will counteract the up/down output of the wind turbines, on a less-than-minute-by-minute basis, 24/7/365

The generators will provide almost all the electricity during low-wind periods, and 100% during high-wind periods, when rotors are feathered and locked.

The capital cost of the entire project was about 8 billion Norwegian Kroner, or about $730 million, as of August 2023, when all 11 units were placed in operation, or $730 million/88 MW = $8,300/kW. See URL

That cost was much higher than the estimated 5 billion NOK in 2019, i.e., 60% higher

The project is located about 70 miles from Norway, which means minimal transport costs of the entire supply to the erection sites

The project produces electricity at about 42 c/kWh, no subsidies, at about 21 c/kWh, with 50% subsidies

In Norway, all work associated with oil rigs is very expensive.

Three shifts of workers are on the rigs for 6 weeks, work 60 h/week, and get 6 weeks off with pay, and are paid well over $150,000/y, plus benefits.

If Norwegian units were used in Maine, the production costs would be even higher in Maine, because of the additional cost of transport of almost the entire supply, including specialized ships and cranes, across the Atlantic Ocean, plus

A high voltage cable would be hanging from each unit, until it reaches bottom, say about 200 to 500 feet.

The cables would need some type of flexible support system

The cables would be combined into several cables to run horizontally to shore, for at least 25 to 30 miles, to several onshore substations, to the New England high voltage grid.

.

https://www.offshore-mag.com/regional-reports/north-sea-europe/arti...

https://en.wikipedia.org/wiki/Floating_wind_turbine

.

.

APPENDIX 3

Offshore Wind in US and UK

Most folks, seeing only part of the picture, write about wind energy issues that only partially cover the offshore wind situation, which caused major declines of the stock prices of Siemens, Oersted, etc., starting at the end of 2020; the smart money got out

All this well before the Ukraine events, which started in February 2022. See costs/kWh in below article

US/UK Governments Offshore Wind Goals

1) 30,000 MW of offshore by 2030, by the cabal of climate extremists in the US government

2) 36,000 MW of offshore by 2030, and 40,000 MW by 2040, by the disfunctional UK government

Those US/UK goals are physically unachievable, even with abundant, low-cost financing, and low inflation, and low-cost energy, materials, labor, and a robust, smooth-running supply chain, to place in service about 9500 MW of offshore during each of the next 7 years, from start 2024 to end 2030, which has never been done before in such a short time. See URL

US/UK 66,000 MW OF OFFSHORE WIND BY 2030; AN EXPENSIVE FANTASY

https://www.windtaskforce.org/profiles/blogs/biden-30-000-mw-of-off...

US Offshore Wind Electricity Production and Cost

Electricity production about 30,000 MW x 8766 h/y x 0.40, lifetime capacity factor = 105,192,000 MWh, or 105.2 TWh. The production would be about 100 x 105.2/4000 = 2.63% of the annual electricity loaded onto US grids.

Electricity Cost, c/kWh: Assume a $550 million, 100 MW project consists of foundations, wind turbines, cabling to shore, and installation, at $5,500/kW.

Production 100 MW x 8766 h/y x 0.40, CF = 350,640,000 kWh/y

Amortize bank loan for $385 million, 70% of project, at 6.5%/y for 20 y, 9.824 c/kWh.

Owner return on $165 million, 30% of project, at 10%/y for 20 y, 5.449 c/kWh

Offshore O&M, about 30 miles out to sea, 8 c/kWh.

Supply chain, special ships, ocean transport, 3 c/kWh

All other items, 4 c/kWh

Total cost 9.824 + 5.449 + 8 + 3 + 4 = 30.273 c/kWh

Less 50% subsidies (ITC, 5-y depreciation, interest deduction on borrowed funds) 15.137 c/kWh

Owner sells to utility at 15.137 c/kWh; developers in NY state, etc., want much more. See Above.

Not included: At a future 30% wind/solar penetration on the grid:

Cost of onshore grid expansion/reinforcement, about 2 c/kWh

Cost of a fleet of plants for counteracting/balancing, 24/7/365, about 2.0 c/kWh

In the UK, in 2020, it was 1.9 c/kWh at 28% wind/solar loaded onto the grid

Cost of curtailments, about 2.0 c/kWh

Cost of decommissioning, i.e., disassembly at sea, reprocessing and storing at hazardous waste sites

.

APPENDIX 4

Levelized Cost of Energy Deceptions, by US-EIA, et al.

Most people have no idea wind and solar systems need grid expansion/reinforcement and expensive support systems to even exist on the grid.

With increased annual W/S electricity percent on the grid, increased grid investments are needed, plus greater counteracting plant capacity, MW, especially when it is windy and sunny around noon-time.

Increased counteracting of the variable W/S output, places an increased burden on the grid’s other generators, causing them to operate in an inefficient manner (more Btu/kWh, more CO2/kWh), which adds more cost/kWh to the offshore wind electricity cost of about 16 c/kWh, after 50% subsidies

The various cost/kWh adders start with annual W/S electricity at about 8% on the grid.

The adders become exponentially greater, with increased annual W/S electricity percent on the grid

The US-EIA, Lazard, Bloomberg, etc., and their phony LCOE "analyses", are deliberately understating the cost of wind, solar and battery systems

Their LCOE “analyses” of W/S/B systems purposely exclude major LCOE items.

Their deceptions reinforced the popular delusion, W/S are competitive with fossil fuels, which is far from reality.

The excluded LCOE items are shifted to taxpayers, ratepayers, and added to government debts.

W/S would not exist without at least 50% subsidies

W/S output could not be physically fed into the grid, without items 2, 3, 4, 5, and 6. See list.

1) Subsidies equivalent to about 50% of project lifetime owning and operations cost,

2) Grid extension/reinforcement to connect remote W/S systems to load centers

3) A fleet of quick-reacting power plants to counteract the variable W/S output, on a less-than-minute-by-minute basis, 24/7/365

4) A fleet of power plants to provide electricity during low-W/S periods, and 100% during high-W/S periods, when rotors are feathered and locked,

5) Output curtailments to prevent overloading the grid, i.e., paying owners for not producing what they could have produced

6) Hazardous waste disposal of wind turbines, solar panels and batteries. See image.

.

.

APPENDIX 5

BATTERY SYSTEM CAPITAL COSTS, OPERATING COSTS, ENERGY LOSSES, AND AGING

https://www.windtaskforce.org/profiles/blogs/battery-system-capital...

EXCERPT:

Annual Cost of Megapack Battery Systems; 2023 pricing

Assume a system rated 45.3 MW/181.9 MWh, and an all-in turnkey cost of $104.5 million, per Example 2

Amortize bank loan for 50% of $104.5 million at 6.5%/y for 15 years, $5.484 million/y

Pay Owner return of 50% of $104.5 million at 10%/y for 15 years, $6.765 million/y (10% due to high inflation)

Lifetime (Bank + Owner) payments 15 x (5.484 + 6.765) = $183.7 million

Assume battery daily usage for 15 years at 10%, and loss factor = 1/(0.9 *0.9)

Battery lifetime output = 15 y x 365 d/y x 181.9 MWh x 0.1, usage x 1000 kWh/MWh = 99,590,250 kWh to HV grid; 122,950,926 kWh from HV grid; 233,606,676 kWh loss

(Bank + Owner) payments, $183.7 million / 99,590,250 kWh = 184.5 c/kWh

Less 50% subsidies (ITC, depreciation in 5 years, deduction of interest on borrowed funds) is 92.3c/kWh

At 10% throughput, (Bank + Owner) cost, 92.3 c/kWh

At 40% throughput, (Bank + Owner) cost, 23.1 c/kWh

Excluded costs/kWh: 1) O&M; 2) system aging, 1.5%/y, 3) 20% HV grid-to-HV grid loss, 4) grid extension/reinforcement to connect battery systems, 5) downtime of parts of the system, 6) decommissioning in year 15, i.e., disassembly, reprocessing and storing at hazardous waste sites. Excluded costs would add at least 15 c/kWh

COMMENTS ON CALCULATION

Almost all existing battery systems operate at less than 10%, per EIA annual reports i.e., new systems would operate at about 92.4 + 15 = 107.4 c/kWh. They are used to stabilize the grid, i.e., frequency control and counteracting up/down W/S outputs. If 40% throughput, 23.1 + 15 = 38.1 c/kWh

A 4-h battery system costs 38.1 c/kWh of throughput, if operated at a duty factor of 40%. That is on top of the cost/kWh of the electricity taken from the HV grid to feed the batteries

Up to 40% could occur by absorbing midday solar peaks and discharging during late-afternoon/early-evening, which occur every day in California and other sunny states. The more solar systems, the greater the peaks.

See above URL for Megapacks required for a one-day wind lull in New England

40% throughput is close to Tesla’s recommendation of 60% maximum throughput, i.e., not charging above 80% full and not discharging below 20% full, to achieve a 15-y life, with normal aging.

Tesla’s recommendation was not heeded by the Owners of the Hornsdale Power Reserve in Australia. They excessively charged/discharged the system. After a few years, they added Megapacks to offset rapid aging of the original system, and added more Megapacks to increase the rating of the expanded system.

Regarding any project, the bank and Owner have to be paid, no matter what. I amortized the bank loan and Owner’s investment

Divide total payments over 15 years by the throughput during 15 years, you get c/kWh, as shown.

There is about a 20% round-trip loss, from HV grid to 1) step-down transformer, 2) front-end power electronics, 3) into battery, 4) out of battery, 5) back-end power electronics, 6) step-up transformer, to HV grid, i.e., you draw about 50 units from the HV grid to deliver about 40 units to the HV grid, because of A-to-Z system losses. That gets worse with aging.

A lot of people do not like these c/kWh numbers, because they have been repeatedly told by self-serving folks, battery Nirvana is just around the corner.

APPENDIX 6

SolarEdge Technologies shares plunged about two weeks ago, after it warned about decreasing European demand.

Solar Panels Are Much More Carbon-Intensive Than Experts are Willing to Admit

https://www.windtaskforce.org/profiles/blogs/solar-panels-are-more-...

SolarEdge Melts Down After Weak Guidance

https://www.windtaskforce.org/profiles/blogs/wind-solar-implosion-s...

The Great Green Crash – Solar Down 40%

https://wattsupwiththat.com/2023/11/08/the-great-green-crash-solar-...

APPENDIX 7

World's Largest Offshore Wind System Developer Abandons Two Major US Projects as Wind/Solar Bust Continues

https://www.windtaskforce.org/profiles/blogs/world-s-largest-offsho...

US/UK 66,000 MW OF OFFSHORE WIND BY 2030; AN EXPENSIVE FANTASY

https://www.windtaskforce.org/profiles/blogs/biden-30-000-mw-of-off...

BATTERY SYSTEM CAPITAL COSTS, OPERATING COSTS, ENERGY LOSSES, AND AGING

https://www.windtaskforce.org/profiles/blogs/battery-system-capital...

Regulatory Rebuff Blow to Offshore Wind Projects; Had Asked for Additional $25.35 billion

https://www.windtaskforce.org/profiles/blogs/regulatory-rebuff-blow...

Offshore Wind is an Economic and Environmental Catastrophe

https://www.windtaskforce.org/profiles/blogs/offshore-wind-is-an-ec...

Four NY offshore projects ask for almost 50% price rise

https://www.windtaskforce.org/profiles/blogs/four-ny-offshore-proje...

EV Owners Facing Soaring Insurance Costs in the US and UK

https://www.windtaskforce.org/profiles/blogs/ev-owners-facing-soari...

U.S. Offshore Wind Plans Are Utterly Collapsing

https://www.windtaskforce.org/profiles/blogs/u-s-offshore-wind-plan...

Values Of Used EVs Plummet, As Dealers Stuck With Unsold Cars

https://www.windtaskforce.org/profiles/blogs/values-of-used-evs-plu...

Electric vehicles catch fire after being exposed to saltwater from Hurricane Idalia

https://www.windtaskforce.org/profiles/blogs/electric-vehicles-catc...

The Electric Car Debacle Shows the Top-Down Economics of Net Zero Don’t Add Up

https://www.windtaskforce.org/profiles/blogs/the-electric-car-debac...

Lifetime Performance of World’s First Offshore Wind System in the North Sea

https://www.windtaskforce.org/profiles/blogs/lifetime-performance-o...

IRENA, a Renewables Proponent, Ignores the Actual Cost Data for Offshore Wind Systems in the UK

https://www.windtaskforce.org/profiles/blogs/irena-a-european-renew...

UK Offshore Wind Projects Threaten to Pull Out of Uneconomical Contracts, unless Subsidies are Increased

https://www.windtaskforce.org/profiles/blogs/uk-offshore-wind-proje...

CO2 IS A LIFE GAS; NO CO2 = NO FLORA AND NO FAUNA

https://www.windtaskforce.org/profiles/blogs/co2-is-a-life-gas-no-c...

AIR SOURCE HEAT PUMPS DO NOT ECONOMICALLY DISPLACE FOSSIL FUEL BTUs IN COLD CLIMATES

https://www.windtaskforce.org/profiles/blogs/air-source-heat-pumps-...

.

IRELAND FUEL AND CO2 REDUCTIONS DUE TO WIND ENERGY LESS THAN CLAIMED

https://www.windtaskforce.org/profiles/blogs/fuel-and-co2-reduction...

APPENDIX 8

Nuclear Plants by Russia

According to the IAEA, during the first half of 2023, a total of 407 nuclear reactors are in operation at power plants across the world, with a total capacity at about 370,000 MW

Nuclear was 2546 TWh, or 9.2%, of world electricity production in 2022

https://www.windtaskforce.org/profiles/blogs/batteries-in-new-england

Rosatom, a Russian Company, is building more nuclear reactors than any other country in the world, according to data from the Power Reactor Information System of the International Atomic Energy Agency, IAEA.

The data show, a total of 58 large-scale nuclear power reactors are currently under construction worldwide, of which 23 are being built by Russia.

.

In Egypt, 4 reactors, each 1,200 MW = 4,800 MW for $30 billion, or about $6,250/kW,

The cost of the nuclear power plant is $28.75 billion.

As per a bilateral agreement, signed in 2015, approximately 85% of it is financed by Russia, and to be paid for by Egypt under a 22-year loan with an interest rate of 3%.

That cost is at least 40% less than US/UK/EU

.

In Turkey, 4 reactors, each 1,200 MW = 4,800 MW for $20 billion, or about $4,200/kW, entirely financed by Russia. The plant will be owned and operated by Rosatom

.

In India, 6 VVER-1000 reactors, each 1,000 MW = 6,000 MW at the Kudankulam Nuclear Power Plant.

Capital cost about $15 billion. Units 1, 2, 3 and 4 are in operation, units 5 and 6 are being constructed

In Bangladesh: 2 VVER-1200 reactors = 2400 MW at the Rooppur Power Station

Capital cost $12.65 billion is 90% funded by a loan from the Russian government. The two units generating 2400 MW are planned to be operational in 2024 and 2025. Rosatom will operate the units for the first year before handing over to Bangladeshi operators. Russia will supply the nuclear fuel and take back and reprocess spent nuclear fuel.

https://en.wikipedia.org/wiki/Rooppur_Nuclear_Power_Plant

.

Rosatom, created in 2007 by combining several Russian companies, usually provides full service during the entire project life, such as training, new fuel bundles, refueling, waste processing and waste storage in Russia, etc., because the various countries likely do not have the required systems and infrastructures

Remember, these nuclear plants reliably produce steady electricity, at reasonable cost/kWh, and have near-zero CO2 emissions

They have about 0.90 capacity factors, and last 60 to 80 years

Nuclear does not need counteracting plants. They can be designed as load-following, as some are in France

.

Wind: Offshore wind systems produce variable, unreliable power, at very high cost/kWh, and are far from CO2-free, on a mine-to-hazardous landfill basis.

They have lifetime capacity factors, on average, of about 0.40; about 0.45 in very windy places

They last about 20 to 25 years in a salt water environment

They require: 1) a fleet of quick-reacting power plants to counteract the up/down wind outputs, on a less-than-minute-by-minute basis, 24/7/365, 2) major expansion/reinforcement of electric grids to connect the wind systems to load centers, 3) a lot of land and sea area, 4) curtailment payments, i.e., pay owners for what they could have produced

Major Competitors: Rosatom’s direct competitors, according to PRIS data, are three Chinese companies: CNNC, CSPI and CGN.

They are building 22 reactors, but it should be noted, they are being built primarily inside China, and the Chinese partners are building five of them together with Rosatom.

American and European companies are lagging behind Rosatom, by a wide margin,” Alexander Uvarov, a director at the Atom-info Center and editor-in-chief at the atominfo.ru website, told TASS.

Tripling Nuclear A Total Fantasy: During COP28, Kerry called for the world to triple nuclear, from 370,200 MW to 1,110,600 MW, by 2050.

https://phys.org/news/2023-12-triple-nuclear-power-cop28.html

Based on past experience in the US and EU, it takes at least 10 years to commission nuclear plants

Plants with about 39 reactors must be started each year, for 16 years (2024 to 2040), to fill the pipeline, to commission the final ones by 2050, in addition to those already in the pipeline.

New nuclear: Kerry’s nuclear tripling by 2050, would add 11% of world electricity generation in 2050. See table

Nuclear was 9.2% of 2022 generation. That would become about 5% of 2050 generation, if some older plants are shut down, and plants already in the pipeline are placed in operation,

Total nuclear would be 11+ 5 = 16%; minimal impact on CO2 emissions and ppm in 2050.

Infrastructures and Manpower: The building of the new nuclear plants would require a major increase in infrastructures and educating and training of personnel, in addition to the cost of the power plants.

https://www.visualcapitalist.com/electricity-sources-by-fuel-in-202....

.

Existing Nuclear, MW, 2022 |

370200 |

|

Proposed tripling |

3 |

|

Tripled Nuxlear, MW, 2050 |

1110600 |

|

New Nuclear, MW |

740400 |

|

MW/reactor |

1200 |

|

Reactors |

617 |

|

New Reactors, rounded |

620 |

|

Reactors/site |

2 |

|

Sites |

310 |

|

New nuclear production, MWh, 2050 |

5841311760 |

|

Conversion factor |

1000000 |

% |

New nuclear production, TWh, 2050 |

5841 |

11 |

World total production, TWh, 2050 |

53000 |

.

APPENDIX 9

LIFE WITHOUT OIL?

Life without oil means many products that are made with oil, such as the hundreds listed below, would need to be provided by wind and solar and hydro, which can be done theoretically, but only at enormous cost.

Folks, including Biden's handlers, wanting to get rid of fossil fuels, such as crude oil, better start doing some rethinking.

The above also applies to natural gas, which is much preferred by many industries, such as glass making, and the chemical and drug industries.

If you do not have abundant, low-cost energy, you cannot have modern industrial economies.

Without Crude Oil, there can be no Electricity.

Every experienced engineer knows, almost all parts of wind/solar/battery systems, for electricity generation and storage, from mining materials to manufacturing parts, to installation and commissioning, in addition to the infrastructures that produce materials, parts, specialized ships, etc., are made from the oil derivatives manufactured from raw crude oil.

.

Views: 76

Comment

-

Comment by Thinklike A. Mountain on August 5, 2024 at 6:13pm

-

Introducing the Latest EV Headache: ‘Charger Hogs’ Causing Endless Lines at Charging Stations

https://www.breitbart.com/tech/2024/08/05/introducing-the-latest-ev...

© 2026 Created by Webmaster.

Powered by

![]()

You need to be a member of Citizens' Task Force on Wind Power - Maine to add comments!

Join Citizens' Task Force on Wind Power - Maine