.

The EV Graveyard Reckoning; Hardly Anyone Wants to Buy a Used One

https://www.windtaskforce.org/profiles/blogs/the-ev-graveyard-recko...

Authored by Mike Shedlock via MishTalk.com,

.

The market for used EVs is plummeting. What will car rental companies do with the used ones?

Problems started in China, but have spread to Europe and the US.

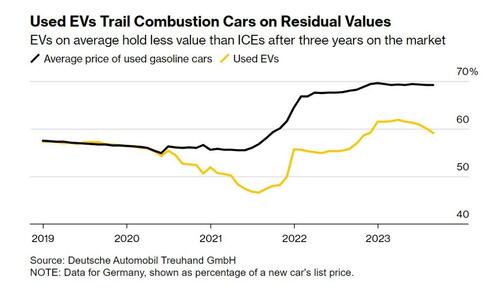

Losing Value After 3 Years: Used EVs retain about 60% of their high original value, whereas gasoline vehicles retain at least 70% of their not so high original value, by the end of year 3.

Losing 40% of a $45,000 EV = $18,000

Losing 30% of $35,000 gasoline vehicle = $10,500

The loss difference wipes out any subsidies.

.

Bloomberg notes China’s Abandoned, Obsolete Electric Cars Are Piling Up in Cities

A subsidy-fueled boom helped build China into an electric-car giant but left weed-infested lots across the nation brimming with unwanted battery-powered vehicles.

On the outskirts of the Chinese city of Hangzhou, a small dilapidated temple overlooks a graveyard of sorts: a series of fields where hundreds upon hundreds of electric cars have been abandoned among weeds and garbage.

Similar pools of unwanted battery-powered vehicles have sprouted up in at least half a dozen cities across China, though a few have been cleaned up. In Hangzhou, some cars have been left for so long that plants are sprouting from their trunks. Others were discarded in such a hurry that fluffy toys still sit on their dashboards.

The cars were likely deserted after the ride-hailing companies that owned them failed, or because they were about to become obsolete as automakers rolled out EV after EV with better features and longer driving ranges. They’re a striking representation of the excess and waste that can happen when capital floods into a burgeoning industry, and perhaps also an odd monument to the seismic progress in electric transportation over the last few years.

Shenzhen-based photographer Wu Guoyong was one of the first people in China to document the waste that results from frenetic development, taking striking drone shots of the piles of abandoned bicycles in 2018. In 2019, he filmed aerial footage of thousands of electric cars in empty lots around Hangzhou and Nanjing, the capital of China’s eastern Jiangsu province.

“The shared bikes and EV graveyards are a result of unconstrained capitalism,” Wu said. “The waste of resources, the damage to the environment, the vanishing wealth, it’s a natural consequence.”

Hoot of the Day

“EV graveyards are a result of unconstrained capitalism.”

Christ oh Mercy! What idiot came up with that "reasoning"?

The Chinese government literally forced people to buy the damn things. Biden is attempting the same in the US.

That article is from August. Let’s flash forward to December 21 to see how things are going in Europe.

No One Wants Used EVs, Making New Ones a Tougher Sell Too

What started in China is not limited to China. A second Bloomberg article reveals No One Wants Used EVs, Making New Ones a Tougher Sell Too

Because most new vehicles in Europe are sold via leases, automakers and dealers who finance these transactions are trying to recover losses from plummeting valuations by raising borrowing costs.

That’s hitting demand in some European markets that were in the vanguard of the shift away from fossil fuel-powered propulsion.

Some of the biggest buyers of new cars, including rental firms, are cutting back on EV adoption because they’re losing money on resales, with Sixt SE dropping Tesla models from its fleet.

The problems are expected to intensify next year, when many of the 1.2 million EVs sold in Europe in 2021 will come off their three-year leasing contracts and enter the secondhand market.

How companies tackle this problem will be key for their bottom lines, consumer confidence and ultimately decarbonization — including the European Union’s plan to phase out sales of new fuel-burning cars by 2035.

“There isn’t used-car demand for EVs,” said Matt Harrison, Toyota Motor Corp.’s chief operating officer in Europe. “That’s really hurting the cost-of-ownership story.”

“One has to slash prices significantly just to get customers to look at EVs,” said Dirk Weddigen von Knapp, who heads a group representing VW and Audi dealers.

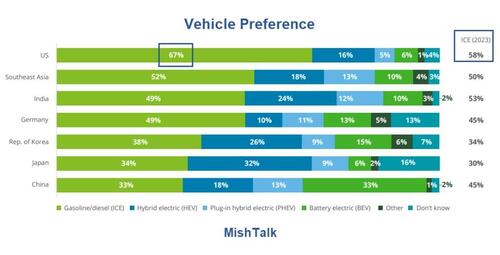

Biden Struggles to Convince People to Buy EVs, Only 12 Percent Seriously Considering

On April 18, I reported Biden Struggles to Convince People to Buy EVs, Only 12 Percent Seriously Considering

On July 13, I noted Despite Huge Incentives, Supply of EVs on Dealer Lots Soars to 92 Days

On August 20, I reported Clean Energy Exploitations and the Death Spiral of an Auto Industry

On October 16, I commented Wake Up Mr. President, Consumers Want Hybrids, Not EVs

More accurately, that should read Wake Up Mr. President, Consumers Don’t Want EVs.

GM Decreases EV Investment in Favor of Buybacks

And on December 2, I noted To Shore Up Share Price, GM Decreases EV Investment in Favor of Buy...

Last month, GM said it would push back the opening of an electric-truck factory in suburban Detroit by a year.

GM also scrapped an earlier goal of producing 400,000 EVs over a roughly two-year stretch, through mid-2024.

Slam Dunk Ford Project Now Unclear

Ford’s EV plan is similarly distressed. Ford pauses and then scales back proposed Michigan facility backed by government funding.

Manchin Blasts Biden’s Definition of “Foreign Entity of Concern”

In the "you can’t make this up" department, Biden’s EV Subsidy Rules Leave Room for Chinese Suppliers

Depending on the definition of “foreign entity of concern” , a number of things are floating in the wind including $7,500 tax credits.

Officials worked for months to define a "foreign entity of concern" but failed.

It is not even clear, if Ford buyers are eligible for tax credits. “Licensing technology, might be permissible under the rules,” officials said.

Who wants to buy a new EV on the basis a $7,500 tax credit “might” be allowed?

Q&A on What’s Delaying the Definition

Q: Why the struggle on the definition of “Foreign Entity of Concern”?

A: Ford wants to use Chinese technology, but GM wants to block it.

For discussion, please see An Epic Battle: Ford to Use China’s Battery Technology, GM Wants it...

My comment then was “Biden is guaranteed to upset someone. That’s what happens when you interfere in the free markets, taking sides.”

Biden is avoiding a firm definition hoping the problem will go away. But it won’t.

Green Fantasy

In the real world, The Green Fantasy Ends Because Consumers Don’t Want to Pay for It

EVs are not selling, because despite massive subsidies to both the manufacturers and consumers, the latter via tax credits, consumers don’t want them.

But here we are, blaming this mess on capitalism. “It’s a natural consequence.“?

What a hoot.

APPENDIX 1

Floating Offshore Wind Systems in the Impoverished State of Maine

https://www.windtaskforce.org/profiles/blogs/floating-offshore-wind...

World Offshore Wind Capacity Placed on Operation in 2021

During 2021, worldwide offshore wind capacity placed in operation was 17,398 MW, of which China 13,790 MW, and the rest of the world 3,608 MW, of which UK 1,855 MW; Vietnam 643 MW; Denmark 604 MW; Netherlands 402 MW; Taiwan 109 MW

Of the 17,398 MW, just 57.1 MW was floating, about 1/3%

At end of 2021, 50,623 MW was in operation, of which just 123.4 MW was floating, about 1/4%

https://www.energy.gov/eere/wind/articles/offshore-wind-market-repo...

Despite the meager floating offshore MW in the world, pro-wind politicians, bureaucrats, etc., aided and abetted by the lapdog Main Media and "academia/think tanks", in the impoverished State of Maine, continue to fantasize about building 3,000 MW of 850-ft-tall floating offshore wind turbines by 2040!!

Maine government bureaucrats, etc., in a world of their own climate-fighting fantasies, want to have about 3,000 MW of floating wind turbines by 2040; a most expensive, totally unrealistic goal, that would further impoverish the already-poor State of Maine for many decades.

Those bureaucrats, etc., would help fatten the lucrative, 20-y, tax-shelters of mostly out-of-state, multi-millionaire, wind-subsidy chasers, who likely have minimal regard for:

1) Impacts on the environment and the fishing and tourist industries of Maine, and

2) Already-overstressed, over-taxed, over-regulated Maine ratepayers and taxpayers, who are trying to make ends meet in a near-zero, real-growth economy.

Those fishery-destroying, 850-ft-tall floaters, with 24/7/365 strobe lights, visible 30 miles from any shore, would cost at least $7,500/ installed kW, or at least $22.5 billion, if built in 2023 (more after 2023)

See below Norwegian floating offshore cost of $8,300/installed kW

Almost the entire supply of the Maine projects would be designed and made in Europe, then transported across the Atlantic Ocean, in specialized ships, also designed and made in Europe, then unloaded at the about $400-million Maine storage/pre-assembly/staging area, then barged to specialized erection ships, also designed and made in Europe, for erection of the floating turbines

About 300 Maine people would have pre-assembly/staging/erection jobs, during the erection phase

The other erection jobs would be by specialized European people, mostly on cranes and ships

About 100 Maine people would have long-term O&M jobs during the 20-y electricity production phase

The projects would produce electricity at about 40 c/kWh, no subsidies, at about 20 c/kWh, with subsidies, the wholesale price at which utilities would buy from Owners (higher prices after 2023)

https://www.maine.gov/governor/mills/news/governor-mills-signs-bill...

The Maine woke bureaucrats are falling over each other to prove their “greenness”, offering $millions of this and that for free, but all their primping and preening efforts has resulted in no floating offshore bids from European companies

The Maine people have much greater burdens to look forward to for the next 20 years, courtesy of the Governor Mills incompetent, woke bureaucracy that has infested the state government

The Maine people need to finally wake up, and put an end to all the climate scare-mongering, which aims to subjugate and further impoverish them, by voting the entire Democrat woke cabal out and replace it with rational Republicans in 2024

The present course leads to financial disaster for the impoverished State of Maine and its people.

The purposely-kept-ignorant Maine people do not deserve such maltreatment

Floating Offshore Wind in Maine

Electricity Cost: Assume a $750 million, 100 MW project consists of foundations, wind turbines, cabling to shore, and installation at $7,500/kW.

Production 100 MW x 8766 h/y x 0.40, CF = 350,640,000 kWh/y

Amortize bank loan for $525 million, 70% of project, at 6.5%/y for 20 years, 13.396 c/kWh.

Owner return on $225 million, 30% of project, at 10%/y for 20 years, 7.431 c/kWh

Offshore O&M, about 30 miles out to sea, 8 c/kWh.

Supply chain, special ships, and ocean transport, 3 c/kWh

All other items, 4 c/kWh

Total cost 13.396 + 7.431 + 8 + 3 + 4 = 35.827 c/kWh

Less 50% subsidies (ITC, 5-y depreciation, interest deduction on borrowed funds) 17.913 c/kWh

Owner sells to utility at 17.913 c/kWh

NOTE: If li-ion battery systems were contemplated, they would add 20 to 40 c/kWh to the cost of any electricity passing through them, during their about 15-y useful service lives! See Part 1 of URL

https://www.windtaskforce.org/profiles/blogs/battery-system-capital-costs-losses-and-aging

NOTE: The above prices compare with the average New England wholesale price of about 5 c/kWh, during the 2009 - 2022 period, 13 years, courtesy of:

Gas-fueled CCGT plants, with low-cost, low-CO2, very-low particulate/kWh

Nuclear plants, with low-cost, near-zero CO2, zero particulate/kWh

Hydro plants, with low-cost, near-zero-CO2, zero particulate/kWh

Cabling to Shore Plus $Billions for Additional Gridwork on Shore

A high voltage cable would be hanging from each unit, until it reaches bottom, say about 200 to 500 feet.

The cables would need some type of flexible support system

There would be about 5 cables, each connected to sixty, 10 MW wind turbines, making landfall on the Maine shore, for connection to 5 substations (each having a 600 MW capacity, requiring several acres of equipment), then to connect to the New England high voltage grid.

The onshore grid will need $billions for expansion/reinforcement to transmit electricity to load centers, mostly in southern New England.

Floating Offshore a Major Financial Burden on Maine People

Rich Norwegian people can afford to dabble in such expensive demonstration follies (See Appendix 2), but the over-taxed, over-regulated, impoverished Maine people would buckle under such a heavy burden, while trying to make ends meet in the near-zero, real-growth Maine economy.

Maine folks need lower energy bills, not higher energy bills.

APPENDIX 2

Floating Offshore Wind in Norway

Equinor, a Norwegian company, put in operation, 11 Hywind, floating offshore wind turbines, each 8 MW, for a total of 88 MW, in the North Sea. The wind turbines are supplied by Siemens, a German company

Production will be about 88 x 8766 x 0.5, claimed lifetime capacity factor = 385,704 MWh/y, which is about 35% of the electricity used by 2 nearby Norwegian oil rigs, which cost at least $1.0 billion each.

On an annual basis, the existing diesel and gas-turbine generators on the rigs, designed to provide 100% of the rigs electricity requirements, 24/7/365, will provide only 65%, i.e., the wind turbines have 100% back up.

The generators will counteract the up/down output of the wind turbines, on a less-than-minute-by-minute basis, 24/7/365

The generators will provide almost all the electricity during low-wind periods, and 100% during high-wind periods, when rotors are feathered and locked.

The capital cost of the entire project was about 8 billion Norwegian Kroner, or about $730 million, as of August 2023, when all 11 units were placed in operation, or $730 million/88 MW = $8,300/kW. See URL

That cost was much higher than the estimated 5 billion NOK in 2019, i.e., 60% higher

The project is located about 70 miles from Norway, which means minimal transport costs of the entire supply to the erection sites

https://www.offshore-mag.com/regional-reports/north-sea-europe/arti...

https://en.wikipedia.org/wiki/Floating_wind_turbine

The project would produce electricity at about 42 c/kWh, no subsidies, at about 21 c/kWh, with 50% subsidies

In Norway, all work associated with oil rigs is very expensive.

Three shifts of workers are on the rigs for 6 weeks, work 60 h/week, and get 6 weeks off with pay, and are paid well over $150,000/y, plus benefits.

Floating Offshore Wind in Maine

If such floating units were used in Maine, the production costs would be even higher in Maine, because of:

1) The additional cost of transport of almost the entire supply, including specialized ships and cranes, across the Atlantic Ocean, plus

2) The additional $300 to $500 million capital cost of any onshore facilities for storing/pre-assembly/staging/barging to erection sites

3) A high voltage cable would be hanging from each unit, until it reaches bottom, say about 200 to 500 feet.

The cables would need some type of flexible support system

The cables would be combined into several cables to run horizontally to shore, for at least 25 to 30 miles, to several onshore substations, to the New England high voltage grid.

.

.

APPENDIX 3

Offshore Wind

Most folks, seeing only part of the picture, write about wind energy issues that only partially cover the offshore wind situation, which caused major declines of the stock prices of Siemens, Oersted, etc., starting at the end of 2020; the smart money got out

All this well before the Ukraine events, which started in February 2022. See costs/kWh in below article

World’s Largest Offshore Wind System Developer Abandons Two Major US Projects as Wind/Solar Bust Continues

https://www.windtaskforce.org/profiles/blogs/world-s-largest-offsho...

US/UK Governments Offshore Wind Goals

1) 30,000 MW of offshore by 2030, by the cabal of climate extremists in the US government

2) 36,000 MW of offshore by 2030, and 40,000 MW by 2040, by the disconnected-from-markets UK government

Those US/UK goals were physically unachievable, even if there were abundant, low-cost financing, and low inflation, and low-cost energy, materials, labor, and a robust, smooth-running supply chain, to place in service about 9500 MW of offshore during each of the next 7 years, from start 2024 to end 2030, which has never been done before in such a short time. See article

US/UK 66,000 MW OF OFFSHORE WIND BY 2030; AN EXPENSIVE FANTASY

https://www.windtaskforce.org/profiles/blogs/biden-30-000-mw-of-off...

NOTE: During an interview, a commentator was reported to say” “renewables are not always reliable”

That shows the types of ignorami driving the bus

The commentator should have said: Wind and solar are never, ever reliable

US Offshore Wind Electricity Production and Cost

Electricity production about 30,000 MW x 8766 h/y x 0.40, lifetime capacity factor = 105,192,000 MWh, or 105.2 TWh. The production would be about 100 x 105.2/4000 = 2.63% of the annual electricity loaded onto US grids.

Electricity Cost, c/kWh: Assume a $550 million, 100 MW project consists of foundations, wind turbines, cabling to shore, and installation, at $5,500/kW.

Production 100 MW x 8766 h/y x 0.40, CF = 350,640,000 kWh/y

Amortize bank loan for $385 million, 70% of project, at 6.5%/y for 20 y, 9.824 c/kWh.

Owner return on $165 million, 30% of project, at 10%/y for 20 y, 5.449 c/kWh

Offshore O&M, about 30 miles out to sea, 8 c/kWh.

Supply chain, special ships, ocean transport, 3 c/kWh

All other items, 4 c/kWh

Total cost 9.824 + 5.449 + 8 + 3 + 4 = 30.273 c/kWh

Less 50% subsidies (ITC, 5-y depreciation, interest deduction on borrowed funds) 15.137 c/kWh

Owner sells to utility at 15.137 c/kWh; developers in NY state, etc., want much more. See Above.

Not included: At a future 30% wind/solar on the grid:

Cost of onshore grid expansion/reinforcement, about 2 c/kWh

Cost of a fleet of plants for counteracting/balancing, 24/7/365, about 2.0 c/kWh

In the UK, in 2020, it was 1.9 c/kWh at 28% wind/solar loaded onto the grid

Cost of curtailments, 2.0 c/kWh

Cost of decommissioning, i.e., disassembly at sea, reprocessing and storing at hazardous waste sites

APPENDIX 4

Levelized Cost of Energy Deceptions, by US-EIA, et al.

Most people have no idea wind and solar systems need grid expansion/reinforcement and expensive support systems to even exist on the grid.

With increased annual W/S electricity percent on the grid, increased grid investments are needed, plus greater counteracting plant capacity, MW, especially when it is windy and sunny around noon-time.

Increased counteracting of the variable W/S output, places an increased burden on the grid’s other generators, causing them to operate in an inefficient manner (more Btu/kWh, more CO2/kWh), which adds more cost/kWh to the offshore wind electricity cost of about 16 c/kWh, after 50% subsidies

The various cost/kWh adders start with annual W/S electricity at about 8% on the grid.

The adders become exponentially greater, with increased annual W/S electricity percent on the grid

The US-EIA, Lazard, Bloomberg, etc., and their phony LCOE "analyses", are deliberately understating the cost of wind, solar and battery systems

Their LCOE “analyses” of W/S/B systems purposely exclude major LCOE items.

Their deceptions reinforced the popular delusion, W/S are competitive with fossil fuels, which is far from reality.

The excluded LCOE items are shifted to taxpayers, ratepayers, and added to government debts.

W/S would not exist without at least 50% subsidies

W/S output could not be physically fed into the grid, without items 2, 3, 4, 5, and 6. See list.

1) Subsidies equivalent to about 50% of project lifetime owning and operations cost,

2) Grid extension/reinforcement to connect remote W/S systems to load centers

3) A fleet of quick-reacting power plants to counteract the variable W/S output, on a less-than-minute-by-minute basis, 24/7/365

4) A fleet of power plants to provide electricity during low-W/S periods, and 100% during high-W/S periods, when rotors are feathered and locked,

5) Output curtailments to prevent overloading the grid, i.e., paying owners for not producing what they could have produced

6) Hazardous waste disposal of wind turbines, solar panels and batteries. See image.

.

.

APPENDIX 5

BATTERY SYSTEM CAPITAL COSTS, OPERATING COSTS, ENERGY LOSSES, AND AGING

https://www.windtaskforce.org/profiles/blogs/battery-system-capital...

EXCERPT:

Annual Cost of Megapack Battery Systems; 2023 pricing

Assume a system rated 45.3 MW/181.9 MWh, and an all-in turnkey cost of $104.5 million, per Example 2

Amortize bank loan for 50% of $104.5 million at 6.5%/y for 15 years, $5.484 million/y

Pay Owner return of 50% of $104.5 million at 10%/y for 15 years, $6.765 million/y (10% due to high inflation)

Lifetime (Bank + Owner) payments 15 x (5.484 + 6.765) = $183.7 million

Assume battery daily usage for 15 years at 10%, and loss factor = 1/(0.9 *0.9)

Battery lifetime output = 15 y x 365 d/y x 181.9 MWh x 0.1, usage x 1000 kWh/MWh = 99,590,250 kWh to HV grid; 122,950,926 kWh from HV grid; 233,606,676 kWh loss

(Bank + Owner) payments, $183.7 million / 99,590,250 kWh = 184.5 c/kWh

Less 50% subsidies (ITC, depreciation in 5 years, deduction of interest on borrowed funds) is 92.3c/kWh

At 10% usage, (Bank + Owner) cost, 92.3 c/kWh

At 40% usage, (Bank + Owner) cost, 23.1 c/kWh

Excluded costs/kWh: 1) O&M; 2) system aging, 1.5%/y, 3) 19% HV grid-to-HV grid loss, 3) grid extension/reinforcement to connect battery systems, 5) downtime of parts of the system, 6) decommissioning in year 15, i.e., disassembly, reprocessing and storing at hazardous waste sites.

NOTE: The 40% throughput is close to Tesla’s recommendation of 60% maximum throughput, i.e., not charging above 80% full and not discharging below 20% full, to achieve a 15-y life, with normal aging

NOTE: Tesla’s recommendation was not heeded by the owners of the Hornsdale Power Reserve in Australia. They added Megapacks to offset rapid aging of the original system, and added more Megapacks to increase the rating of the expanded system.

COMMENT ON CALCULATION

Regarding any project, the bank and the owner have to be paid, no matter what.

Therefore, I amortized the bank loan and the owner’s investment

If you divide the total of the payments over 15 years by the throughput during 15 years, you get the cost per kWh, as shown.

According to EIA annual reports, almost all battery systems have throughputs less than 10%. I chose 10% for calculations.

A few battery systems have higher throughputs, if they are used to absorb midday solar and discharge it during peak hour periods of late-afternoon/early-evening.

They may reach up to 40% throughput. I chose 40% for calculations

Remember, you have to draw about 50 units from the HV grid to deliver about 40 units to the HV grid, because of a-to-z system losses. That gets worse with aging.

A lot of people do not like these c/kWh numbers, because they have been repeatedly told by self-serving folks, battery Nirvana is just around the corner, which is a load of crap.

APPENDIX 6

Solar is in a Downturn, Similar to Offshore Wind

SolarEdge Technologies shares plunged about two weeks ago, after it warned about decreasing European demand.

Solar Panels Are Much More Carbon-Intensive Than Experts are Willing to Admit

https://www.windtaskforce.org/profiles/blogs/solar-panels-are-more-...

SolarEdge Melts Down After Weak Guidance

https://www.windtaskforce.org/profiles/blogs/wind-solar-implosion-s...

The Great Green Crash – Solar Down 40%

https://wattsupwiththat.com/2023/11/08/the-great-green-crash-solar-...

APPENDIX 7

Miscellaneous Sources of Information

World's Largest Offshore Wind System Developer Abandons Two Major US Projects as Wind/Solar Bust Continues

https://www.windtaskforce.org/profiles/blogs/world-s-largest-offsho...

US/UK 66,000 MW OF OFFSHORE WIND BY 2030; AN EXPENSIVE FANTASY

https://www.windtaskforce.org/profiles/blogs/biden-30-000-mw-of-off...

BATTERY SYSTEM CAPITAL COSTS, OPERATING COSTS, ENERGY LOSSES, AND AGING

https://www.windtaskforce.org/profiles/blogs/battery-system-capital...

Regulatory Rebuff Blow to Offshore Wind Projects; Had Asked for Additional $25.35 billion

https://www.windtaskforce.org/profiles/blogs/regulatory-rebuff-blow...

Offshore Wind is an Economic and Environmental Catastrophe

https://www.windtaskforce.org/profiles/blogs/offshore-wind-is-an-ec...

Four NY offshore projects ask for almost 50% price rise

https://www.windtaskforce.org/profiles/blogs/four-ny-offshore-proje...

EV Owners Facing Soaring Insurance Costs in the US and UK

https://www.windtaskforce.org/profiles/blogs/ev-owners-facing-soari...

U.S. Offshore Wind Plans Are Utterly Collapsing

https://www.windtaskforce.org/profiles/blogs/u-s-offshore-wind-plan...

Values Of Used EVs Plummet, As Dealers Stuck With Unsold Cars

https://www.windtaskforce.org/profiles/blogs/values-of-used-evs-plu...

Electric vehicles catch fire after being exposed to saltwater from Hurricane Idalia

https://www.windtaskforce.org/profiles/blogs/electric-vehicles-catc...

The Electric Car Debacle Shows the Top-Down Economics of Net Zero Don’t Add Up

https://www.windtaskforce.org/profiles/blogs/the-electric-car-debac...

Lifetime Performance of World’s First Offshore Wind System in the North Sea

https://www.windtaskforce.org/profiles/blogs/lifetime-performance-o...

Solar Panels Are Much More Carbon-Intensive Than Experts are Willing to Admit

https://www.windtaskforce.org/profiles/blogs/solar-panels-are-more-...

IRENA, a Renewables Proponent, Ignores the Actual Cost Data for Offshore Wind Systems in the UK

https://www.windtaskforce.org/profiles/blogs/irena-a-european-renew...

UK Offshore Wind Projects Threaten to Pull Out of Uneconomical Contracts, unless Subsidies are Increased

https://www.windtaskforce.org/profiles/blogs/uk-offshore-wind-proje...

CO2 IS A LIFE GAS; NO CO2 = NO FLORA AND NO FAUNA

https://www.windtaskforce.org/profiles/blogs/co2-is-a-life-gas-no-c...

AIR SOURCE HEAT PUMPS DO NOT ECONOMICALLY DISPLACE FOSSIL FUEL BTUs IN COLD CLIMATES

https://www.windtaskforce.org/profiles/blogs/air-source-heat-pumps-...

.

IRELAND FUEL AND CO2 REDUCTIONS DUE TO WIND ENERGY LESS THAN CLAIMED

https://www.windtaskforce.org/profiles/blogs/fuel-and-co2-reduction...

APPENDIX 8

Nuclear Plants by Russia

According to the IAEA, during the first half of 2023, a total of 407 nuclear reactors are in operation at power plants across the world, with a total capacity at about 370,000 MW

Nuclear was 2546 TWh, or 9.2%, of world electricity production in 2022

https://www.windtaskforce.org/profiles/blogs/batteries-in-new-england

Rosatom, a Russian Company, is building more nuclear reactors than any other country in the world, according to data from the Power Reactor Information System of the International Atomic Energy Agency, IAEA.

The data show, a total of 58 large-scale nuclear power reactors are currently under construction worldwide, of which 23 are being built by Russia.

Nuclear Plants: A typical plant may have up to 4 reactors, usually about 1,200 MW each

.

In Egypt, 4 reactors, each 1,200 MW = 4,800 MW for $30 billion, or about $6,250/kW,

The cost of the nuclear power plant is $28.75 billion.

As per a bilateral agreement, signed in 2015, approximately 85% of it is financed by Russia, and to be paid for by Egypt under a 22-year loan with an interest rate of 3%.

That cost is at least 40% less than US/UK/EU

.

In Turkey, 4 reactors, each 1,200 MW = 4,800 MW for $20 billion, or about $4,200/kW, entirely financed by Russia. The plant will be owned and operated by Rosatom

.

In India, 6 VVER-1000 reactors, each 1,000 MW = 6,000 MW at the Kudankulam Nuclear Power Plant.

Capital cost about $15 billion. Units 1, 2, 3 and 4 are in operation, units 5 and 6 are being constructed

.

Rosatom, created in 2007 by combining several Russian companies, usually provides full service during the entire project life, such as training, new fuel bundles, refueling, waste processing and waste storage in Russia, etc., because the various countries likely do not have the required systems and infrastructures

Nuclear vs Wind: Remember, these nuclear plants reliably produce steady electricity, at reasonable cost/kWh, and have near-zero CO2 emissions

They have about 0.90 capacity factors, and last 60 to 80 years

Nuclear do not require counteracting plants. They can be designed to be load-following, as some are in France

.

Offshore wind systems produce variable, unreliable power, at very high cost/kWh, and are far from CO2-free, on a

mine-to-hazardous landfill basis.

They have lifetime capacity factors, on average, of about 0.40; about 0.45 in very windy places

They last about 20 to 25 years in a salt water environment

They require: 1) a fleet of quick-reacting power plants to counteract the up/down wind outputs, on a less-than-minute-by-minute basis, 24/7/365, 2) major expansion/reinforcement of electric grids to connect the wind systems to load centers, 3) a lot of land and sea area, 4) curtailment payments, i.e., pay owners for what they could have produced

Major Competitors: Rosatom’s direct competitors, according to PRIS data, are three Chinese companies: CNNC, CSPI and CGN.

They are building 22 reactors, but it should be noted, they are being built primarily inside China, and the Chinese partners are building five of them together with Rosatom.

American and European companies are lagging behind Rosatom, by a wide margin,” Alexander Uvarov, a director at the Atom-info Center and editor-in-chief at the atominfo.ru website, told TASS.

Tripling Nuclear? During COP28 in opulent Dubai, Kerry called for the world to triple CO2-free nuclear, from 370,200 MW to about 1,110,600 MW, by 2050.

https://phys.org/news/2023-12-triple-nuclear-power-cop28.html

Based on past experience in the US and EU, it takes at least 10 years to commission nuclear plants

That means, plants with about 39 reactors must be started each year, for 16 years (2024 to 2040), to fill the pipeline, to commission the final ones by 2050, in addition to those already in the pipeline.

New nuclear: Kerry’s nuclear tripling by 2050, would be 11% of the 2050 world electricity generation. See table

Existing nuclear: If some of the older plants are shut down, and plants already in the pipeline are placed in operation, that nuclear would be about 5% to the world total generation in 2050

Nuclear was 9.2% of 2022 generation.

Total nuclear would be about 16%, and would have minimal impact on CO2 emissions and ppm in 2050.

Infrastructures and Manpower: The building of the new nuclear plants would require a major increase in infrastructures and educating and training of personnel, in addition to the cost of the power plants.

https://www.visualcapitalist.com/electricity-sources-by-fuel-in-202....

.

Existing Nuclear, MW, 2022 |

370200 |

|

Proposed tripling |

3 |

|

Tripled Nuxlear, MW, 2050 |

1110600 |

|

New Nuclear, MW |

740400 |

|

MW/reactor |

1200 |

|

Reactors |

617 |

|

New Reactors, rounded |

620 |

|

Reactors/site |

2 |

|

Sites |

310 |

|

New nuclear production, MWh, 2050 |

5841311760 |

|

Conversion factor |

1000000 |

% |

New nuclear production, TWh, 2050 |

5841 |

11 |

World total production, TWh, 2050 |

53000 |

APPENDIX 9

Electricity prices vary by type of customer

Retail electricity prices are usually highest for residential and commercial consumers because it costs more to distribute electricity to them. Industrial consumers use more electricity and can receive it at higher voltages, so supplying electricity to these customers is more efficient and less expensive. The retail price of electricity to industrial customers is generally close to the wholesale price of electricity.

In 2022, the U.S. annual average retail price of electricity was about 12.49¢ per kilowatthour (kWh).1

The annual average retail electricity prices by major types of utility customers in 2022 were:

Residential, 15.12 ¢/kWh

Commercial, 12.55 ¢/kWh

Industrial, 8.45 ¢/kWh

Transportation, 11.66 ¢/kWh

Electricity prices vary by locality

Electricity prices vary by locality based on the availability of power plants and fuels, local fuel costs, and pricing regulations. In 2022, the annual average retail electricity price for all types of electric utility customers ranged from 39.85¢ per kWh in Hawaii to 8.24¢ per kWh in Wyoming.2.

Prices in Hawaii are high relative to other states mainly because most of its electricity is generated with petroleum fuels that must be imported into the state.

1 U.S. Energy Information Administration, Electric Power Monthly, Table 5.3, February 2023, preliminary data.

2 U.S. Energy Information Administration, Electric Power Monthly, Table 5.6.B, February 2023, preliminary data.

Last updated: June 29, 2023, with data from the Electric Power Monthly, February 2023; data for 2022 are preliminary.

See URL

https://www.eia.gov/energyexplained/electricity/prices-and-factors-...

In the US, the cost of electricity to ratepayers ranges from about 8 c/kWh (Wyoming) to 40 c/kWh (Hawaii), for an average of about 12.5 c/kWh.

US ratepayers buy about 4000 billion kWh/y from utilities, costing about $500 BILLION/Y

With a lot of wind/solar/batteries/EVs by 2050, and ratepayers buying 8000 billion kWh/y, because of electrification, the average rate to ratepayers would be about 25 c/kWh,

US ratepayers would pay: two times the kWh x two times the price/kWh = $2,000 BILLION/Y

Electric bills would increase by a factor of 4, if all that scare-mongering renewable nonsense were implemented

NOTE: All numbers are without inflation, i.e., constant 2023 dollars

APPENDIX 10

LIFE WITHOUT OIL?

Life without oil means many products that are made with oil, such as the hundreds listed below, would need to be provided by wind and solar and hydro, which can be done theoretically, but only at enormous cost.

Folks, including Biden's handlers, wanting to get rid of fossil fuels, such as crude oil, better start doing some rethinking.

The above also applies to natural gas, which is much preferred by many industries, such as glass making, and the chemical and drug industries.

If you do not have abundant, low-cost energy, you cannot have modern industrial economies.

Without Crude Oil, there can be no Electricity.

Every experienced engineer knows, almost all the parts of wind, solar and battery systems, for electricity generation and storage, from mining materials to manufacturing parts, to installation and commissioning, in addition to the infrastructures that produce materials, parts, specialized ships, etc., are made from the oil derivatives manufactured from raw crude oil.

There is no escaping of this reality, except in green la-la-land.

.

Views: 63

Comment

© 2026 Created by Webmaster.

Powered by

![]()

You need to be a member of Citizens' Task Force on Wind Power - Maine to add comments!

Join Citizens' Task Force on Wind Power - Maine