The Richmond Valley Battery Energy Storage System lithium-iron phosphate, LFP, battery system is being developed at the proposed Richmond Valley Solar Farm site at Myrtle Creek by Ark Energy, which, along with the Sun Metals Zinc Refinery in Queensland, a subsidiary of Korea Zinc.

The battery project, which will use LFP battery chemistry, will have a power capacity of 275 MW and an energy storage capacity of up to 2,200-MWh over eight hours.

.

Korea Zinc is working on other energy storage mechanisms closer to its Townsville base, from where it supplies much of Asia with non-ferrous metals.

The Richmond Valley project is being developed by Ark Energy, which has a mandate to provide Korea Zinc with enough renewable energy for the production of green zinc.

.

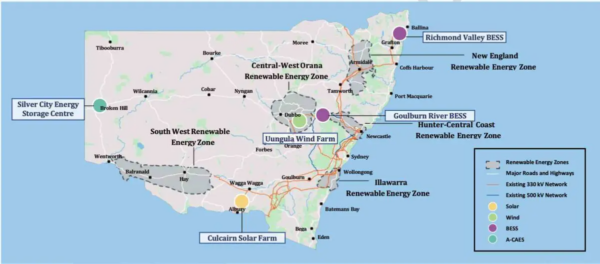

The Richmond Valley battery project is one of five energy infrastructure projects representing 750 MW of renewable energy generation and 524 MW/4,192 MWh of 8-h storage that have been successful to the New South Wales (NSW) government’s latest tender round , as it prepares for the exit of coal-fired power generation from the state’s electricity grid.

.

“NSW is now almost halfway there on our 2030 renewable generation target, and over a quarter of the way there on our long-duration storage target,” said NSW Energy Minister Penny Sharpe.

.

.

The five projects represent $2.84 billion in private sector investment in NSW’s renewable energy infrastructure. .

The energy storage projects are expected to be operational by 2028 and are expected to contribute an estimated 1,000 jobs, $1 billion in local supply chain benefits and $20 million towards First Nations initiatives.

.

With an energy storage capacity of up to 2.2 GWh over eight hours, the Richmond Valley battery storage project exceeds other big batteries planned for Australia and globally, including

Akaysha’s Waratah Super Battery, which has a capacity of 850 MW/1,680 MWh, and

Orana battery in NSW at 415 MW/1,660 MWh.

.

The Richmond Valley battery project will be built alongside the proposed Richmond Valley Solar Farm being developed near Casino in northern NSW.

The project includes the construction, operation, maintenance and decommissioning of the solar farm with a capacity of 500 MW.

The project includes the installation of approximately one million PV panels on a mounted tracking system and will connect to the grid via the Coffs Harbour to Lismore 330 kV powerline that transects the site.

.

Australia is near the Tropics, so solar energy makes vastly more sense than in northern Maine

.

Australian solar conditions make it ideal for industrial giants such as Korea Zinc, the world’s largest producer of zinc, lead and silver, and its subsidiaries.

.

Korea Zinc is currently trying to reduce the total dependence on China for all things battery-related.

The company is also ramping up its renewable energy production – with Ark Energy, among others – as well as ramping up its recycling activities to keep critical raw materials in production loops. According to US stipulations, if battery materials were originally produced in China but recycled outside of FEOC, these materials regain eligibility for US subsidies.

The clean production of energy and short transport distances mark two important issues in compliance with standards for government investments in important industries. Refining zinc takes a lot of energy. If battery materials are not produced and transported with the lowest possible carbon footprint, they face exclusion from many governmental support schemes globally as countries try to decarbonise their industries.

Ark Energy is tasked with decarbonising the Korea Zinc subsidiary Sun Metal’s Townsville zinc refinery. The plant is currently Queensland’s second biggest electricity user and chews up between AUD 50 million to AUD 80 million in energy costs each year.

Korea Zinc has recognised Australia’s combination of assets, making it one of the world’s ideal locations for industrial activity, with production on-site reducing excessive transportation costs of renewable energy – particularly from neighbouring regions with high energy needs.

In terms of durational storage, lithium battery projects are said to be limited to eight hours of storage potential.

.

Basically, an 8-hour storage system consists of two 4-h systems.

A battery system rated at 300MW/2400 MWh (8-h duration) would effectively be 2-300MW/1200 MWh systems

During discharge, one would be operated from 80% full to 20% full, and then the second one would be operated from 80% full to 20% full, for a total of 8 hours of storage.

Tesla recommends not charging above 80% full and not discharging below 20% full to achieve normal aging and 15-y life.

.

The charge and discharge rates can be variable.

The capital cost would be about $500 to $600/installed kWh.

The turnkey capital cost of a 300 MW/2400 MWh system wound be 2 x 1200 x 1000 x 600/kWh = $1,440,000,000

The system would operate at a maximum of about 0.4 of capacity, on an annual basis; on some days somewhat higher, on other days somewhat lower.

It is almost impossible to achieve 0.4 of capacity on an annual average basis

.

Remember, this is new territory

Impoverished Maine does not have the wherewithal to be a rah-rah, heroic pioneer

All this is a huge subsidy to solar and wind systems that are owned by mostly by the tax shelters of the moneyed elites of out of state and in foreign contries.

.

BTW, nothing is stated regarding the capital cost and economics of the project.

Below is an analysis that shows the cost per delivered kWh is off-the-charts expensive.

At 40% lifetime throughput, which is near impossible to achieve, the cost is at least 38.1 c/kWh

.

Increased CO2 ppm in atmosphere is an essential life gas that increases growth of fauna and flora, and increases crop yields to feed hungry people.

Net zero by 2050 to reduce CO2 is a taxpayer-subsidized, criminal enterprise by self-serving woke idiots to undermine Mother Nature, at the expense of all of us.

.

BATTERY SYSTEM CAPITAL COSTS, OPERATING COSTS, ENERGY LOSSES, AND AGING

https://www.windtaskforce.org/profiles/blogs/battery-system-capital...

by Willem Post

.

Utility-scale, battery system pricing usually is not made public, but for this system it was.

Neoen, in western Australia, has just turned on its 219 MW/ 877 MWh Tesla Megapack battery, the largest in western Australia.

Ultimately, it will be a 560 MW/2,240 MWh battery system, $1,100,000,000/2,240,000 kWh = $491/kWh, delivered as AC, late 2024 pricing. Smaller capacity systems will cost much more than $500/kWh

.

Annual Cost of Megapack Battery Systems; 2023 pricing

Assume a system rated 45.3 MW/181.9 MWh, and an all-in turnkey cost of $104.5 million, per Example 2

Amortize bank loan for 50% of $104.5 million at 6.5%/y for 15 years, $5.484 million/y

Pay Owner return of 50% of $104.5 million at 10%/y for 15 years, $6.765 million/y (10% due to high inflation)

Lifetime (Bank + Owner) payments 15 x (5.484 + 6.765) = $183.7 million

Assume battery daily usage for 15 years at 10%, and loss factor = 1/(0.9 *0.9)

Battery lifetime output = 15 y x 365 d/y x 181.9 MWh x 0.1, usage x 1000 kWh/MWh = 99,590,250 kWh to HV grid; 122,950,926 kWh from HV grid; 233,606,676 kWh loss

(Bank + Owner) payments, $183.7 million / 99,590,250 kWh = 184.5 c/kWh

Less 50% subsidies (tax credits, 5-y depreciation, loan interest deduction) is 92.3c/kWh

Subsidies shift costs from project Owners to ratepayers, taxpayers, government debt

At 10% throughput, (Bank + Owner) cost, 92.3 c/kWh

At 40% throughput, (Bank + Owner) cost, 23.1 c/kWh

.

Excluded costs/kWh: 1) O&M; 2) system aging, 1.5%/y, 3) 20% HV grid-to-HV grid loss, 4) grid extension/reinforcement to connect battery systems, 5) downtime of parts of the system, 6) decommissioning in year 15, i.e., disassembly, reprocessing and storing at hazardous waste sites. Excluded costs would add at least 15 c/kWh

COMMENTS ON CALCULATION

Almost all existing battery systems operate at less than 10%, per EIA annual reports i.e., new systems would operate at about 92.4 + 15 = 107.4 c/kWh. They are used to stabilize the grid, i.e., frequency control and counteracting up/down W/S outputs. If 40% throughput, 23.1 + 15 = 38.1 c/kWh.

A 4-h battery system costs 38.1 c/kWh of throughput, if operated at a duty factor of 40%.

That is on top of the cost/kWh of the electricity taken from the HV grid to feed the batteries

Up to 40% could occur by absorbing midday solar peaks and discharging during late-afternoon/early-evening, which occur every day in California and other sunny states. The more solar systems, the greater the peaks.

See URL for Megapacks required for a one-day wind lull in New England

40% throughput is close to Tesla’s recommendation of 60% maximum throughput, i.e., not charge above 80% and not discharge below 20%, to achieve a 15-y life, with normal aging.

Owners of battery systems with fires, likely charged above 80% and discharged below 20% to maximize profits.

Tesla’s recommendation was not heeded by the Owners of the Hornsdale Power Reserve in Australia. They excessively charged/discharged the system. After a few years, they added Megapacks to offset rapid aging of the original system, and added more Megapacks to increase the rating of the expanded system.

http://www.windtaskforce.org/profiles/blogs/the-hornsdale-power-res...

Regarding any project, the bank and Owner have to be paid, no matter what. I amortized the bank loan and Owner’s investment

Divide total payments over 15 years by the throughput during 15 years, you get c/kWh, as shown.

There is about a 20% round-trip loss, from HV grid to 1) step-down transformer, 2) front-end power electronics, 3) into battery, 4) out of battery, 5) back-end power electronics, 6) step-up transformer, to HV grid, i.e., you draw about 50 units from the HV grid to deliver about 40 units to the HV grid, because of A-to-Z system losses. That gets worse with aging.

A lot of people do not like these c/kWh numbers, because they have been repeatedly told by self-serving folks, battery Nirvana is just around the corner.

.

NOTE: Aerial photos of large-scale battery systems with many Megapacks, show many items of equipment, other than the Tesla supply, such as step-down/step-up transformers, switchgear, connections to the grid, land, access roads, fencing, security, site lighting, i.e., the cost of the Tesla supply is only one part of the battery system cost at a site.

.

NOTE: Battery system turnkey capital costs and electricity storage costs likely will be much higher in 2023 and future years, than in 2021 and earlier years, due to: 1) increased inflation rates, 2) increased interest rates, 3) supply chain disruptions, which delay projects and increase costs, 4) increased energy prices, such as of oil, gas, coal, electricity, etc., 5) increased materials prices, such as of tungsten, cobalt, lithium, copper, manganese, etc., 6) increased labor rates.

You need to be a member of Citizens' Task Force on Wind Power - Maine to add comments!

Join Citizens' Task Force on Wind Power - Maine