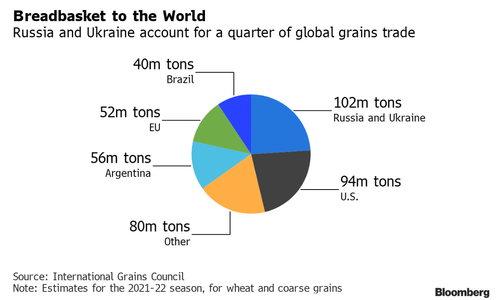

Global food prices jumped to a new record high, soaring the fastest on record, as the conflict in Ukraine unleashed food supply shocks across the world, by Tyler Durden

“The current conflict between Ukraine and the Russian Federation is increasing the risk of a further deterioration of the food insecurity situation at global level,” the FAO said in a recent food insecurity assessment (pdf).

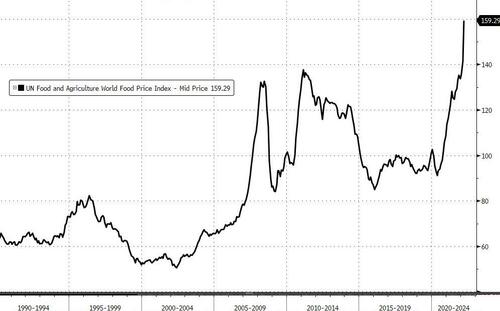

March's food price index from the Food and Agriculture Organization of the United Nations (FAO) printed 159.3 points in March, up 19.15 points from February, when it had already reached record highs. The index was up

33.6% from the same time last year.

Views: 167

Comment

-

Comment by Willem Post on April 15, 2022 at 11:38am

-

EXCERPT from:

BATTERY SYSTEM CAPITAL COSTS, ENERGY LOSSES, AND AGING

https://www.windtaskforce.org/profiles/blogs/battery-system-capital...

PART 6

General Comments

All of the above is well known by the engineers of larger utilities, who proudly own multiple grid-scale battery systems.

Those utilities have the detailed operating and cost data to perform refined analyses.

They share some of their data with the EIA, on an anonymous basis.They do not publish the analyses on their websites, or in their reports, or in press releases, because there would likely be major blowback from a better-informed citizenry.

Utilities think it is best to keep things fuzzy, cozy, and happy, with lots of smiling employees, always there to serve you.

Big Bucks are at Stake in the Small State of VermontIf the "big bucks" are multi-$billion in a small, mostly rural state, just imagine what they would be in a large, mostly industrial state.

VELCO, which owns the Vermont high voltage grid, wants $2.2 BILLION to upgrade its grid to be ready for EVs, HPs, and more wind and solar, as part of fighting 1) climate change and 2) global warming

GMP, a major Vermont utility, with about 78% of Vermont’s electricity market, owned by Canadian/French investors, likely wants a similar capital infusion for 1) extending/augmenting its distribution grids and 2) building out a state-wide system of EV chargers.

GMP gets its funding, via the VT-Public Utilities Commission, the VT-Department of Public Service, and the VT Legislature

APPENDIX 1

The various costs of making wind turbines have gone up, especially in Europe, due to increases in energy, materials, and transport prices

The cost of financing has increased, i.e., higher interest rates, because of the Biden consumer price index, CPI, increasing at 8.5%/y, and the producer price index, PPI, increasing at 11.5%/y

Owners typically put up 50% of the turnkey capital cost of a wind, solar, or battery project, the rest is financed.

Owners typically make 9%/y on their investment, when bank interest rates are low, say 3.5%/y.

Owners may want to make a higher %/y, when bank interest rates are high.

All this translates in Owners having to sell their wind electricity at much higher prices, and oops, wind is:

1) No longer “competitive with fossil” (not that it ever was)

2) Certainly not competitive with existing low-cost, domestic natural gas, nuclear and hydro

The same is happening with the pricing of:

1) Solar electricity

http://www.windtaskforce.org/profiles/blogs/cost-shifting-is-the-na...

2) Grid-scale battery system services

https://www.windtaskforce.org/profiles/blogs/battery-system-capital...

3) EVs, and EV chargers, and EV charging

https://www.windtaskforce.org/profiles/blogs/poor-economics-of-elec...

https://www.windtaskforce.org/profiles/blogs/electric-bus-systems-l...

All that will make it much more expensive to reduce CO2 to “save the world from climate change” (if that were actually possible).

However, reducing CO2 reduces biomass growth and food crop growth, which has already been reduced, due to a shortage of fertilizer and phosphate from Belarus and Russia; their prices have become stratospheric. A world recession, or worse, may be in the offing.

Remember, all this is due to the US relentlessly pushing to expand NATO beyond East Germany, which it had promised not to do in 1990, and turning Ukraine into a NATO-armed battering ram, after the US-instigated color revolution in 2014, to crush Russia. See URL

https://www.windtaskforce.org/profiles/blogs/the-plot-is-thickening...

-

Comment by Willem Post on April 11, 2022 at 6:28pm

-

With wind and solar, batteries are required, because on low-wind nights, which in New England occur almost EVERY DAY, both wind and solar are zero or near-zero.

Batteries to the rescue?

EXCERPT from:

BATTERY SYSTEM CAPITAL COSTS, ENERGY LOSSES, AND AGING

https://www.windtaskforce.org/profiles/blogs/battery-system-capital...PART 5

Battery Systems Losses due to Absorbing Midday Solar Bulges

Those losses are a major battery operating cost almost never mentioned by stakeholders. Those losses certainly are not obvious to lay people

About 219,000 kWh/y is drawn from the grid to absorb midday solar bulges during the year.

This solar electricity experiences a 20% loss as it passes through the battery system, AC-to-AC basis

This solar electricity has a heavily subsidized, all-in cost of about 22 c/kWh, if part of “net-metered program”. See URL

http://www.windtaskforce.org/profiles/blogs/cost-shifting-is-the-na...The remaining 182,500 kWh/y is fed to the grid during peak hours of late-afternoon/early-evening, when wholesale prices are about 8 c/kWh

The resulting electricity loss is about 219000 – 182500 = 36,500 kWh/y

The resulting dollar loss is about 219000 x 22 c/kWh – 182500 x 8 c/kWh = $48180 – $14600 = $33,580/y, or 33580/182500 = 18.4 c/kWh of annual throughputThe $33,580 is just one of the annual costs of dealing with midday solar bulges.

A part of the annual costs for financing, owning and operating the battery system should also be allocated to dealing with midday solar bulges. (See PART 4)Those costs are definitely not charged to solar system Owners (the grid disturbers) or battery system Owners

A utility likely “takes care of it” by burying it in the next rate increase request to the VT PUC, i.e., that loss is shifted onto ratepayers, taxpayers, and government debtsGeneral Comments

All of the above is well known by the engineers of larger utilities, who proudly own multiple grid-scale battery systems.

Those utilities have the detailed operating and cost data to perform refined analyses.

They share some of their data with the EIA, on an anonymous basis.

They do not publish the analyses on their websites, or in their reports, or in press releases, because there would likely be major blowback from a better-informed citizenry.

Utilities think it is best to keep things fuzzy, cozy, and happy, with lots of smiling employees, always there to serve you.Big Bucks are at Stake in the Small State of Vermont

If the “big bucks” are multi-$billion in a small state, just imagine what they would be in a large state.

VELCO wants $2.2 BILLION to upgrade its Vermont HV grid to be ready for EVs, HPs and more Solar and Wind, as part of fighting 1) climate change, 2) global warming, 3) COVID, 4) China, 5) Russia, 6) Anything

GMP, a major Vermont utility, with about 78% of Vermont’s electricity market, owned by Canadian/French investors, likely wants a similar capital infusion for 1) extending/augmenting its distribution grids and 2) building out a state-wide system of EV chargers.

GMP gets its funding, via the VT PUC, the VT-DPS, and the Legislature

-

Comment by Willem Post on April 9, 2022 at 5:30am

-

BATTERY SYSTEM CAPITAL COSTS, ENERGY LOSSES, AND AGING

https://www.windtaskforce.org/profiles/blogs/battery-system-capital...

This article has five parts

PART 1

Turnkey Capital Costs of Site-specific, Custom-designed, Utility-grade, Grid-scale Battery Systems

Academic articles often assume low turnkey capital cost of battery systems at about $350/kWh, delivered as AC. Such articles do not mention if that cost covers the entire battery system site, including step-up and step-down transformers.

The 2022 turnkey price of a lithium-ion, Tesla Megapack, are:

Purchase

Capacity

Energy

Duration

Location

Cap Cost

Price

Units

MW

MWh

h

State

$million

$/kWh

1

1.295

2.570

2

Vermont

1.842

717

2

2.590

5.140

2

Vermont

2.808

546

3

3.885

7.710

2

Vermont

4.189

543

1

0.770

3.070

4

Vermont

1.566

510

2

1.540

6.140

4

Vermont

2.957

482

3

2.310

9.210

4

Vermont

4.409

479

Those battery ratings fit into a standard container W, 286 inch x D, 85 inch x H, 99 inch

If multiple Megapacks are purchased, the $/kWh becomes less. See URL

https://www.tesla.com/megapack/design

The 2022 price is 24.5% greater than the 2021 price.

The 2025 cost likely will be much higher, due to increased inflation, increased interest rates, and increases in materials prices, such as of Tungsten, Cobalt, and Lithium.

https://cms.zerohedge.com/s3/files/inline-images/2022-03-21_15-28-4...

https://www.zerohedge.com/commodities/tesla-hikes-megapack-prices-c...

NOTE: After looking at several aerial photos of large-scale battery systems with many Megapacks, it is clear many other items of equipment are shown, other than the Tesla supply, i.e., the cost of the Tesla supply is only one part of the total battery system cost at a site.

The EIA, an Agency of the US Department of Energy

The Energy Information Agency, EIA, has collected turnkey capital costs and operating data of the energy sector for many decades.

The EIA surveys cover various battery types, not just Li-ion.

The first EIA report was issued in 2017, and covered grid-scale battery system in use for all of 2015

The most recent EIA report was issued in 2021, and covered grid-scale battery systems in use for all of 2019

The EIA projects about $500/kWh by 2025, based on trends.

However, high inflation rates, high interest rates, and high materials costs will increase the average costs/kWh for 2021, and later years.

The trend of the data revealed, the turnkey capital cost decreased after 2015, as shown by the table and image, and the average duration of battery discharge increased from 0.5 h in 2015 to 3.2 h in 2019, because they are increasingly used to absorb midday solar output bulges and deliver that electricity during peak hours in the late-afternoon/early-evening

Excluded Costs from the EIA Estimates

Any project has an upfront turnkey capital cost, and ongoing annual operating and maintenance costs and periodic renovations, the same as a house, or a battery system. Some of the annual financing cost, O&M cost, etc., are listed below:

1) Financing costs, such as due to amortized loans or bonds, are assumed at about 6%/y for 15 years. This is a significant annual expense. This percentage likely would be greater in 2025 than at present, because high inflation rates require high interest rates.

NOTE:

House mortgage rates increased from about 2.8%/y in 2021 to 4.25%/y in 2022, and likely will increase in future years.

Bank loans for battery systems increased from about 3.5%/y in 2021 to about 5%/y in 2022.

2) Owner’s return on investment of about 9%/y, which is a standard annual return utilities make on their investments. This is a significant annual expense. This percentage may increase in future years, to offset inflationary effects.

3) Battery system throughput loss of about 20%, which increases with aging, as measured from distribution grid or high-voltage grid, AC-to-AC. This is a significant annual expense.

4) All other battery system operating and maintenance cost, including security, insurance, etc. The total is a significant annual expense

5) Subsidies, such as cash grants, tax credits, accelerated depreciation, loan interest deductions, waiving of state and local taxes, fees and surcharges, waiving of local real estate taxes, etc.

The intent of subsidies is to shift capital and operating costs from Owners to Others, by about 45%.

This enables the Owner to offer battery services at a much lesser cost/kWh of battery system throughput.

This makes the use of batteries look politically more palatable.

Any shifted costs are paid by Others, i.e., ratepayers, taxpayers and added to government debts

No cost ever disappears, per Economics 101

Batteries:

1) Are expensive, all-in about $700/kWh, delivered as AC, in NE, in 2019, with little prospect of a significant decrease.

2) Last at most 15 years, if operated between 15% full and 80% full, and in a temperature-controlled enclosure.

Some experts claim operation between 20% full to 80% full is more prudent to achieve 15-y life, with less aging

3) Age at about 1.5%/y (the capacity loss would be about 25% in year 15)

4) May catch fire, i.e., high insurance costs. This is a significant annual expense

https://www.windtaskforce.org/profiles/blogs/high-costs-of-wind-sol...

EIA 2020 Report, which includes systems in operation during all of 2018

The EIA graph, based on surveys of battery system users, shows slowly decreasing costs after 2018

The average price was $625/kWh in 2018

It appears, the range of values likely would become $900/kWh to 450/kWh in 2025.

The values would be near the higher end of the range in New England.

https://www.eia.gov/todayinenergy/detail.php?id=45596

EIA 2021 Report, which includes systems in operation during all of 2019The US average turnkey capital cost of battery systems was about $589/kWh, delivered as AC, in 2019.

The average price decreased from $625 in 2018, to $589 in 2019, or a $36/kWh decrease

The average price would decrease to $500 in 2025, if the annual decreases were about $15. See image

The NE average turnkey capital cost for such systems was about $700/kWh, delivered as AC, in 2019

Those average prices will not decrease, unless major technical breakthroughs are discovered, and subsequently implemented on a large scale.

See table 3 and page 18 of EIA URLhttps://www.eia.gov/analysis/studies/electricity/batterystorage/pdf...

Such grid-scale battery systems operate 8766 hours per year

Annual capacity factor is about 0.5, i.e., a working throughput of about 50% of rated throughput

https://www.windtaskforce.org/profiles/blogs/economics-of-utility-s...

Table 1 combines the data of five EIA reports

NOTE: The EIA projected cost is $500/kWh for 2025, but that value likely will not be attainable, due to high inflation, high financing costs, and high materials costs

Table 1/Battery system turnkey cost

Range

Duration

Average

Year

$/kWh as AC

hour

$/kWh as AC

2015

2500 to 1750

0.5

2102

2016

2800 to 750

1.5

1417

2017

1500 to 700

1.8

755

2018

1250 to 500

2.4

625

2019

1050 to 475

3.2

589

2025

900 to 450

500

© 2026 Created by Webmaster.

Powered by

![]()

You need to be a member of Citizens' Task Force on Wind Power - Maine to add comments!

Join Citizens' Task Force on Wind Power - Maine