Citizens' Task Force on Wind Power - Maine

It’s Time to End Wind and Solar’s Free Ride on Federal Lands

Finishing the Free Ride

On Tuesday, July 29th, the U.S. Department of the Interior Secretary Doug Burgum announced the agency would be “curbing preferential treatment for unreliable, subsidy-dependent wind and solar energy.” The One Big Beautiful Bill Act starts to roll back the Inflation Reduction Act’s (IRA) lavish financial incentives, but wind and solar are still getting a free ride on federal lands.

Here is one suggestion for the Interior Department: require renewables projects to pay a federal royalty that is shared with the states, just like oil, natural gas, and coal.

Coal, oil, and natural gas produced on federal land are subject to royalties, a tax which takes between 12.5 percent and 18.75 percent of the natural resources’ taxable value. These royalties generated $12.8 billion in revenues for American taxpayers in 2024, and these revenues are typically shared fifty-fifty with the states, ensuring locals share in the financial benefits from natural resource development in their backyards. These revenue-sharing agreements provide important revenue streams for Western states where the federal government is a large landowner.

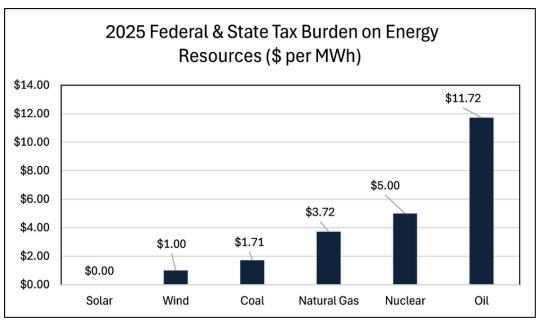

Take Wyoming, a state where 48 percent of the land is owned and managed by the federal government. Always On Energy Research and the Wyoming Liberty Group determined that wind and solar projects contribute much less in tax revenues on an energy equivalent basis than oil, natural gas, and coal.

Wyoming levies a state tax of just $1 per megawatt-hour (MWh) of electricity produced by wind turbines built on privately owned lands, and solar generation is not taxed at all. Oil pays nearly $11.72 per MWh in federal and state taxes, while natural gas pays nearly $3.72 per MWh, and coal $1.71 per MWh.

https://substack-post-media.s3.amazonaws.com/public/images/5294cd75-5b15-4242-89d2-9f883e34d161_554x325.png","srcNoWatermark":null,"fullscreen":null,"imageSize":null,"height":325,"width":554,"resizeWidth":646,"bytes":46337,"alt":null,"title":null,"type":"image/png","href":null,"belowTheFold":true,"topImage":false,"internalRedirect":"https://energybadboys.substack.com/i/169879082?img=https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F5294cd75-5b15-4242-89d2-9f883e34d161_554x325.png","isProcessing":false,"align":null,"offset":false}" alt="" srcset="https://substackcdn.com/image/fetch/$s_!JPBu!,w_424,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F5294cd75-5b15-4242-89d2-9f883e34d161_554x325.png 424w, https://substackcdn.com/image/fetch/$s_!JPBu!,w_848,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F5294cd75-5b15-4242-89d2-9f883e34d161_554x325.png 848w, https://substackcdn.com/image/fetch/$s_!JPBu!,w_1272,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F5294cd75-5b15-4242-89d2-9f883e34d161_554x325.png 1272w, https://substackcdn.com/image/fetch/$s_!JPBu!,w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F5294cd75-5b15-4242-89d2-9f883e34d161_554x325.png 1456w" sizes="100vw" loading="lazy" class="sizing-normal" />

https://substack-post-media.s3.amazonaws.com/public/images/5294cd75-5b15-4242-89d2-9f883e34d161_554x325.png","srcNoWatermark":null,"fullscreen":null,"imageSize":null,"height":325,"width":554,"resizeWidth":646,"bytes":46337,"alt":null,"title":null,"type":"image/png","href":null,"belowTheFold":true,"topImage":false,"internalRedirect":"https://energybadboys.substack.com/i/169879082?img=https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F5294cd75-5b15-4242-89d2-9f883e34d161_554x325.png","isProcessing":false,"align":null,"offset":false}" alt="" srcset="https://substackcdn.com/image/fetch/$s_!JPBu!,w_424,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F5294cd75-5b15-4242-89d2-9f883e34d161_554x325.png 424w, https://substackcdn.com/image/fetch/$s_!JPBu!,w_848,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F5294cd75-5b15-4242-89d2-9f883e34d161_554x325.png 848w, https://substackcdn.com/image/fetch/$s_!JPBu!,w_1272,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F5294cd75-5b15-4242-89d2-9f883e34d161_554x325.png 1272w, https://substackcdn.com/image/fetch/$s_!JPBu!,w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F5294cd75-5b15-4242-89d2-9f883e34d161_554x325.png 1456w" sizes="100vw" loading="lazy" class="sizing-normal" />

Over the next five years, Wyoming’s wind capacity is expected to double. Unsurprisingly, wind developers are seeking to build 60 percent of these projects on federal lands because it allows them to avoid paying Wyoming’s $1 per MWh tax on wind generation while still building new wind generation in the state.

If DOI were to levy a modest three percent royalty on wind and solar generation on federal lands—still less than the lowest royalties on coal, oil, or natural gas—it could yield $12.5 million for the state of Wyoming, and $13 million for the federal government per year, by 2030.

https://energybadboys.substack.com/p/its-time-to-end-wind-and-solars-free?utm_source=substack&utm_medium=email&utm_content=share&action=share","text":"Share","action":null,"class":null}" data-component-name="ButtonCreateButton" class="button-wrapper">Share

It's not just that wind and solar can operate royalty-free on federal land. The Biden administration had given wind and solar developers an 80 percent-off sweetheart deal on fees for leasing lands managed by the Bureau of Land Management.

Luckily, the Trump Interior Department is walking that rule back, with Interior Secretary Doug Burgum noting the move will ensure “taxpayers get the maximum return from the responsible use of our public lands.” That’s the right approach, and the administration should scour its rules, including resource management plans, for the prioritization of wind and solar projects over other worthwhile uses of federal lands.

If oil, natural gas, and coal developers are expected to pay for the privilege of extracting resources from federal lands, it’s only fair that wind and solar developers pay for the privilege to tap into wind currents and harvest solar rays. Western states like Wyoming shouldn’t be left empty-handed when their federal lands are poached by subsidized wind and solar projects. A federal royalty on wind and solar would help ensure that public resources serve the public good rather than the politically favored.

Thinklike A. Mountain

To Kill An Operation Mockingbird: Tulsi Goes To War With The CIA's Propaganda Yobbos

https://www.zerohedge.com/political/kill-operation-mockingbird-tuls...

on Tuesday